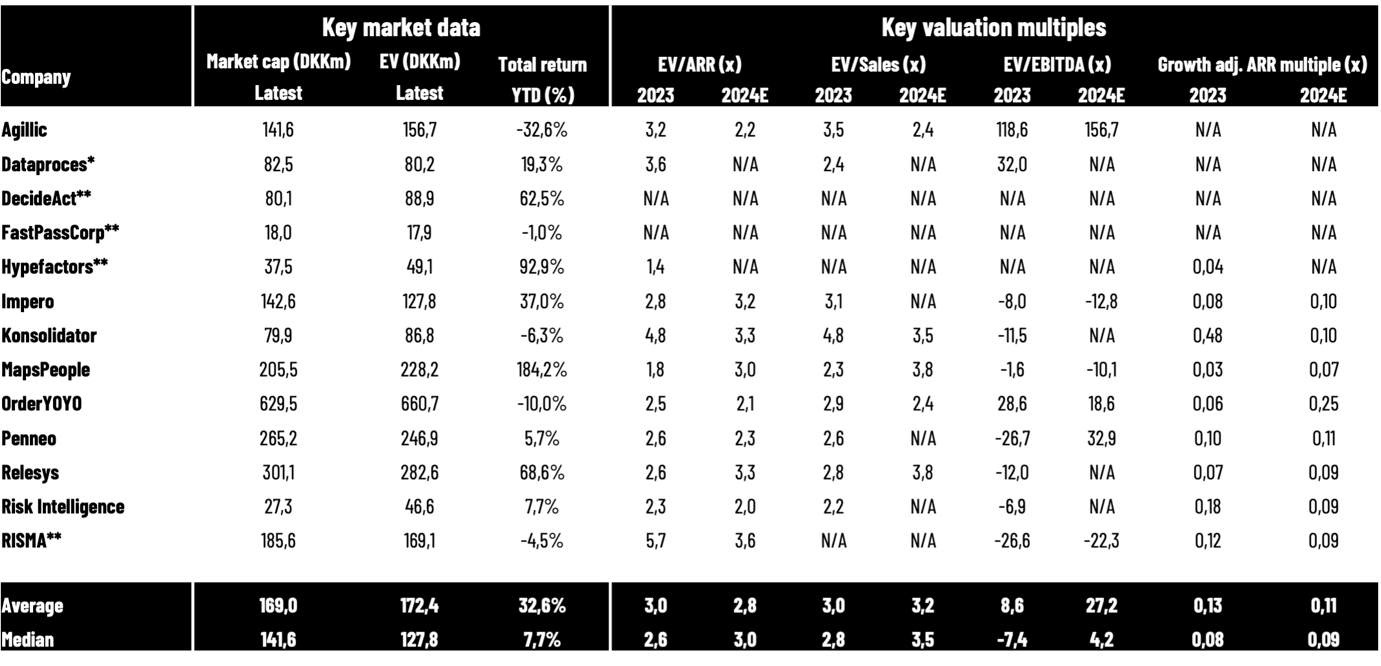

During March 2024, we observed share price rebounds for some of the companies in the Danish SaaS sector. Across the Danish SaaS sector (comprised of 13 SaaS companies), the average share price increase was 22% in March, primarily driven by large rebounds in shares such as MapsPeople (103%), FastPassCorp (87%), and Relesys (65%). As a result, the median P/ARR multiple (using the latest reported ARR) increased significantly to 4.0x ARR by the end of March 2024 (from 3.1x ARR by the end of February 2024). For comparison, the US SaaS sector median P/ARR multiple increased to 6.8x by the end of March 2024 (from 6.6x P/ARR by the end of February 2024).

Looking ahead, incorporating the companies’ new 2024 guidance and the net debt/cash, the median EV/ARR (2024E) is, however, lower at 3.0x. For perspective, this is still significantly below the US SaaS sector (larger companies) of EV/NTM Sales of 6.4x according to data from Clouded Judgement.

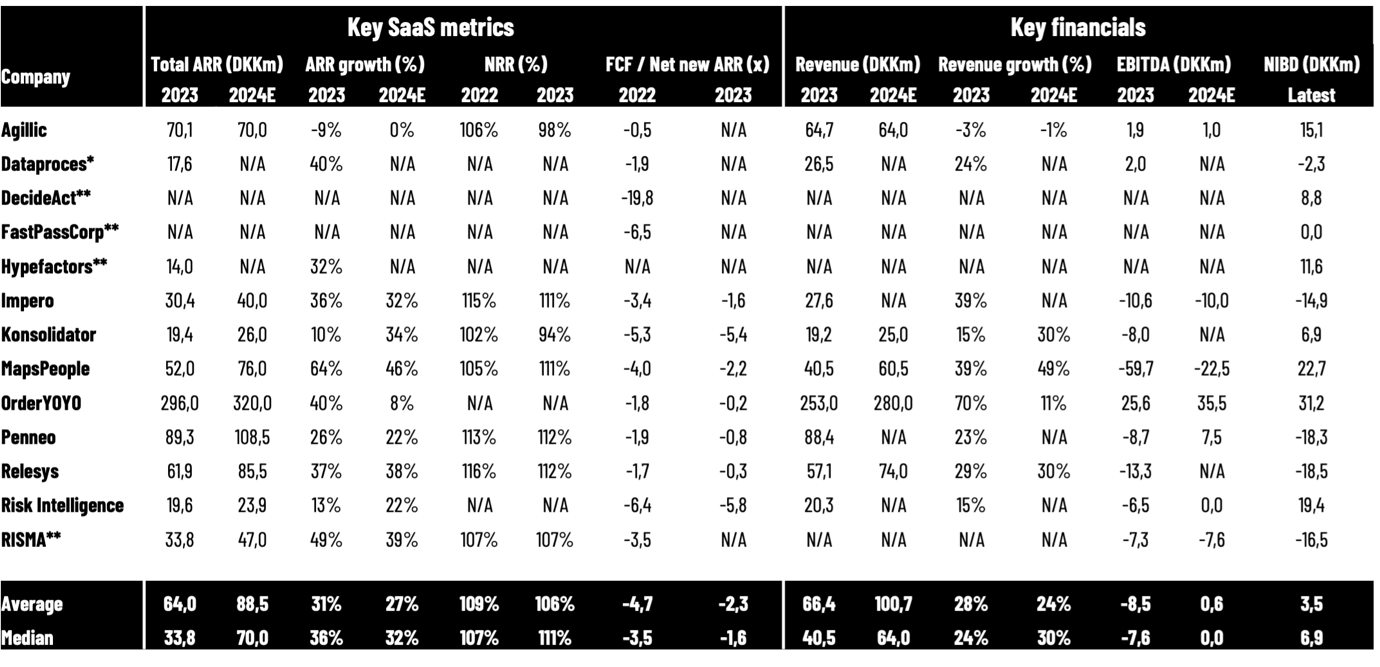

The increasing focus on capital efficiency is also observed in the benchmark data we collect from the 2023 reports across the Danish SaaS Sector. The median FCF/Net New ARR (also referred to as burn multiple) has improved significantly from -3.5x in 2022 to -1.6x in 2023.

After a positive first quarter of 2024 for stocks on index levels, the “broadening out” to small- and mid-cap could continue. However, the US 10Y bond yield is still at a high level of approx. 4.3%, and there could be a rotation away from the interest-sensitive tech companies if inflation data surpasses expectations, and the Fed’s expectations of rate cuts will change. We also cover a potential new IPO in the US in this newsletter.

Source: HC Andersen Capital and The SaaS Capital Index

Recap of the Danish SaaS reporting season

In March, MapsPeople took most of the headlines in the Danish SaaS sector. The company reported its annual report for 2023 on 19 March 2024 with results in line with its recent guidance. In 2023, ARR grew to DKK 52.0m, corresponding to 63% growth YoY. Despite the high growth rate, 2023 was a year of change and challenges for MapsPeople. A key message from the report is that MapsPeople expects to continue its high growth rates in 2024 (39-54% ARR growth YoY), and importantly, projects to be fully funded until reaching positive cash flow from operations towards the end of 2024. During 2023, MapsPeople has reduced its cost base significantly by DKK 30m on an annualized basis. After its large share price increase in March 2024, the MapsPeople share is up 164% year-to-date (4 April 2024) and is now second on the list of the best share price performance among all Danish listed companies.

Other high-growing companies such as Impero and Relesys also reported their annual reports for 2023, which were in line with their recent guidance, growing ARR 34% YoY and 37% YoY, respectively.

Impero’s 2024 ARR growth outlook is in the range of 25-38%. Importantly, Impero also commented on its strategic direction 2026. With the company’s current capital foundation, Impero aims to at least double its customer base and become cash flow positive on a recurring basis before the end of 2026. However, Impero also comments that new growth opportunities could arise, implying that the strategic direction, investment levels and thus also capital needs will be reassessed.

Looking across the Danish SaaS sector, we have summarized key results (ARR and EBITDA) for 2023 and 2024E for most of the companies, as only a few companies will report in April. Note that not all companies report on EBITDA guidance. In terms of ARR growth, the median ARR growth is expected to be 32%, slightly lower than the median ARR growth rate of 36% in 2023. The median expected EBITDA is around breakeven (DKK 0.0) in 2024, which is an improvement from a median of DKK -7.6m in 2023. We have also included an overview of the burn multiple (FCF/Net New ARR) for 2022 and 2023, showing an overall positive trend for the companies’ capital efficiency. The median burn multiple across the sector has improved from -3.5x (2022) to -1.6x (2023).

Note: The overview only includes companies with preliminary results/audited results for 2023 and announced 2024 guidance (midpoint in guidance ranges). We use data until 31 March 2024. Source: HC Andersen Capital and company reports (manually collected).

US global SaaS sector: “Things aren’t getting worse, but not quite getting better yet”

Summing up the 2023 reports and the companies’ 2024 outlook from the global sector with US-listed SaaS companies, Clouded Judgement (Jamin Ball) concludes that “things aren’t getting worse, but not quite getting better yet.” However, a positive development has been the net new ARR added in Q4 2023, which was close to the all-time high in Q4 2021, yet Q4 is “always” seasonal strong for enterprise B2B SaaS.

Based on EV/Sales (NTM growth) multiples from the Clouded Judgement newsletter, the high growth median was 10.7x (companies with >27% projected NTM growth), the mid growth median was 9.2x (companies with >15-27% projected NTM growth), and the low growth median was 4.5x (growth <15%). The overall median is 6.4x EV/Sales (NTM).

In our recent newsletter, we also highlighted that the IPO window is opening which could have a positive spillover effect on the whole SaaS sector and growth companies in general. At the beginning of this week, the US data cybersecurity company, Rubrik, filed its initial S1 statement to the SEC, a preparation file for an IPO. Rubrik provides its cloud-based data protection SaaS platform to enterprises. In January, Rubrik had more than 1,700 subscription customers with an annual contract value of approx. USD 100,000. In the recent financial year ending in January 2024, the company grew just below 5%, however, the subscription revenue grew 40% YoY, which demonstrates its transformation to a recurring SaaS model. News about Rubrik’s potential IPO timing, valuation, etc. is expected to be covered over the coming month.

Looking at one of the recent US IPOs, even though it is not related to the SaaS sector, Reddit had a good start following its IPO, as the share price is approx. 35% above its IPO price of USD 34 (4 April 2024). From a SaaS perspective, however, Klaviyo – the marketing SaaS company (latest US SaaS IPO from September 2023) – is trading approx. 19% below its IPO price of USD 30.

With the positive sentiment on the stock market and a potential new IPO, this could continue the “broadening out” with share price increases across smaller SaaS companies. On the other hand, the US 10Y bond yield is still at a relatively high level of approx. 4.3% and could increase more if the Fed’s expectations of rate cuts change. This could potentially dampen the risk appetite in the tech sector.

Overview of key metrics for Danish SaaS companies

We have collected data from 13 listed Danish SaaS companies. The overview will be updated on an ongoing basis. Market capitalizations are latest updated on 31 March 2024. Read the note below the tables for more detailed information.

Source: HC Andersen Capital and company reports.

Note: The table above summarizes key market data, key valuation multiples, key SaaS metrics, and key financials for Danish-listed SaaS companies reporting ARR (some software companies such as cBrain do not include ARR in their reporting and are not included). *Dataproces has a skewed/different accounting period than a regular calendar year. **The companies with ** have not reported the annual report for 2023 based on data by the end of March 2024. We apply the companies’ reported SaaS metrics, however, there are differences in the reporting methodologies, as there are no regulations or standards yet. When applying 2024E for the companies, we are using the companies’ guidance ranges (midpoint). We apply OrderYOYO’s pro forma net revenue in this overview (app smart consolidated full year) for both valuation multiples and growth rates. FCF/Net new ARR (2022) is calculated by taking FCF (cash flow from operations minus CAPEX, primarily investments in intangible assets) and the net ARR increase by the end of 2022 compared to the end of 2021. Penneo adjusts its FCF/Net new ARR ratio by DKK 2.4m due to costs related to the listing on the Main Market. Taking these costs out, the ratio will decline from -1.9x to -1.7x. In the calculation of net-interest-bearing debt (NIBD) for the companies in 2022, we have applied interest-bearing debt (including leasing liabilities) minus cash. This implies that negative values are companies with more cash than interest-bearing debt on their balance sheet. We apply the latest reported NIBD (for most companies) and market capitalizations from 31 December 2023 in our calculations of Enterprise Value multiples for 2023, and market capitalizations from 31 March 2024 for 2024E. MapsPeople’s net revenue retention rate (NRR) is based on MapsIndoors. All data is collected manually from reports, and we cannot guarantee the correctness of all data.

Disclaimer: HC Andersen Capital receives payment from some of the mentioned SaaS companies (Agillic, Impero, MapsPeople, OrderYOYO, and Penneo) for a Digital IR/Corporate Visibility subscription agreement. All content in this newsletter is only for informational purposes. HC Andersen Capital cannot guarantee the correctness of all data in this newsletter.