Overview of the H1 2024 earnings season

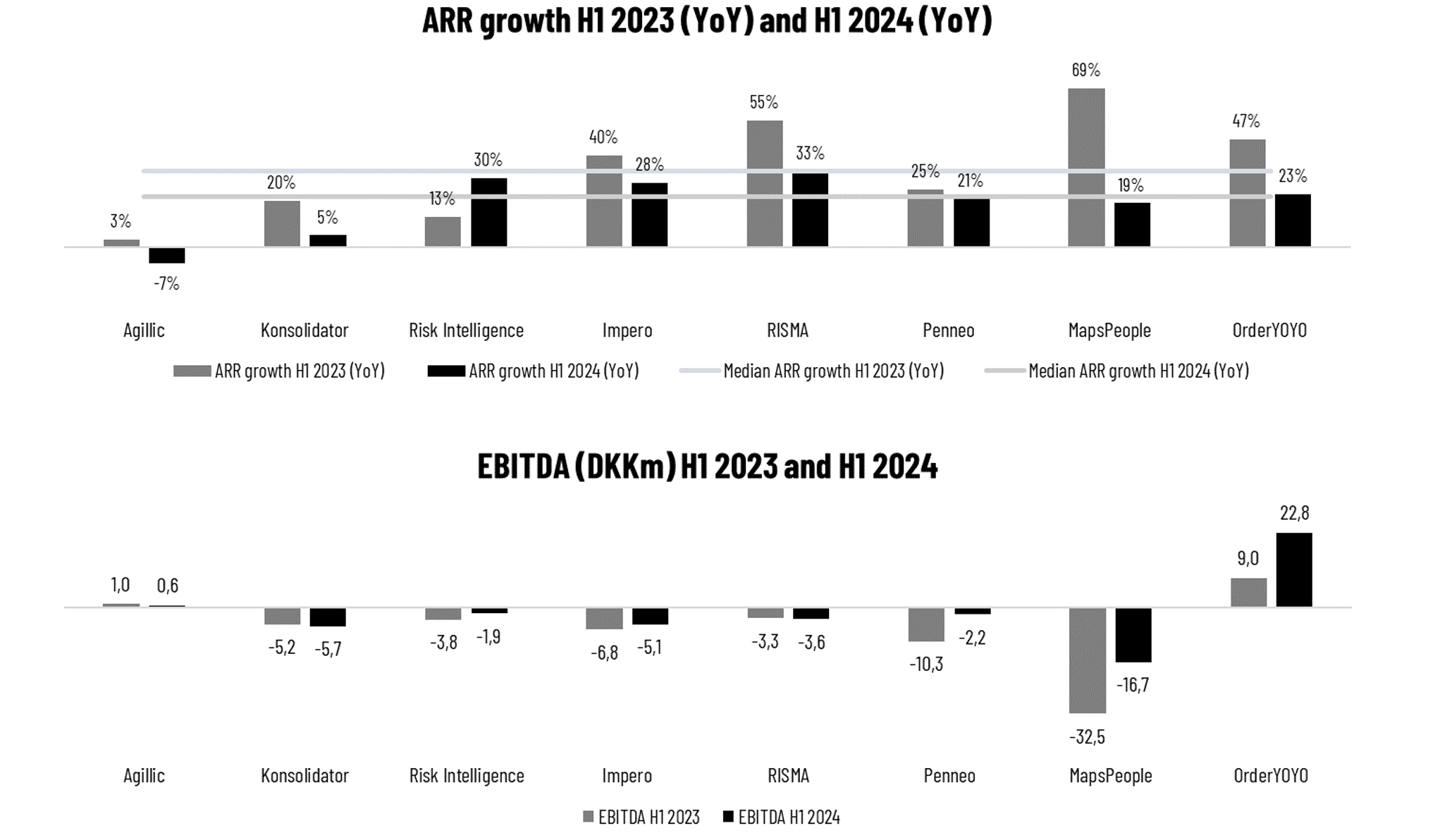

On an overall level, we think that there is somewhat more optimism across many of the Danish-listed SaaS companies when looking into H2 2024 although ARR YoY growth has decreased from 33% YoY (median) in H1 2023 to 22% YoY (median) in H1 2024. Besides a more difficult software market outlook – in general – across many end markets, the companies’ focus has also shifted more to capital efficiency and improved profitability.

Both the ARR growth YoY development in H1 2023 vs. H1 2024 and EBITDA developments (DKKm) can be found below.

Note: Dataproces is not included in this comparison overview due to the skewed accounting period. Note that there may be some changes in ARR reporting methodologies which can blur the comparison both across years and companies. Source: HC Andersen Capital collected data from company reports.

News and reports point to some optimism in H2 despite no acceleration in H1

Penneo has momentum in Belgium, and the company has also announced a large KYC customer in Germany. In Belgium, the momentum is driven by the Sign product, yet the company expects to launch its KYC product in the fall in Belgium. As Penneo sees limited competition for KYC product offerings in Belgium, this could further accelerate its growth in Belgium. Looking across the Nordic SaaS space, Germany is somewhat seen as the next big growth market, however, the country’s digitization maturity is slower than we have seen in the Nordics. Even though Penneo has announced its first KYC customer in Germany (a major German A&A, Tax, and Corporate Law firm), Penneo also highlights that it takes time to gain traction etc. in Germany. Penneo maintained its 2024 guidance, expecting ARR growth between 18-25% YoY (21% in H1 2024) and EBITDA in the range DKK 5-10m.

Impero is one of the few Danish SaaS companies with a significant market position in Germany and the German-speaking countries. In H1 2024, 53% of the new ARR generated came from the DACH region, and the strong market position is seen by the customer base with almost 20% of the German DAX 40 index as customers on the Impero platform. The company has also won its first client in Belgium, which is a Big4 firm offering Impero’s service for multinational clients. With an improved EBITDA and especially its operational cash flow, Impero has maintained a solid cash position and financial flexibility to continue investing in growth. The 2024 guidance was maintained, expecting ARR growth between 25-38% YoY (28% in H1 2024) and EBITDA between DKK -9m and -11m.

It has not been any secret that raising capital has been tough for many companies. However, MapsPeople managed to raise gross proceeds of approx. DKK 36m in a difficult capital market, which included Spar Nord Bank. As a result, MapsPeople can now focus on investing in growth activities, including M&A. In MapsPeople’s Q2/H1 report, there was no big news on the financial side, yet the company also stated that they are raising the capital to accelerate its growth after a period with increasing focus on costs. The guidance for 2024 was maintained.

After a difficult period, Agillic could be over the worst with expectations of growth in H2 and the closing of its tax credit case with an overall positive conclusion back in July. After technology consolidations and M&A-driven changes, primarily in Q1 2024, Agillic’s ARR subscriptions decreased by 6% in Q2/H1 2024. However, Agillic maintained its 2024 guidance following expected growth from both existing clients and new sales in the second half of 2024. Cost measurements have been implemented in H1 2024, implying that EBITDA remained positive at DKK 0.6m in H1 2024 (DKK 1.0m in H1 2023). The guidance for 2024 was maintained.

Global macro uncertainty remains

As shown in the latest newsletter, the net new ARR development has been challenged in the global SaaS sector. The uncertain macro environment also affects the sales cycles for the SaaS companies. Nevertheless, there could be some pent-up demand after hesitant buyers in recent quarters. We also saw that last year when Q4 was strong it gave some optimism into 2024 even though this has not played out. The macro uncertainty has also affected the global stock markets which have been highly volatile during August, primarily due to fears of recession from macro data. Looking into the beginning of September, this volatile climate remains.

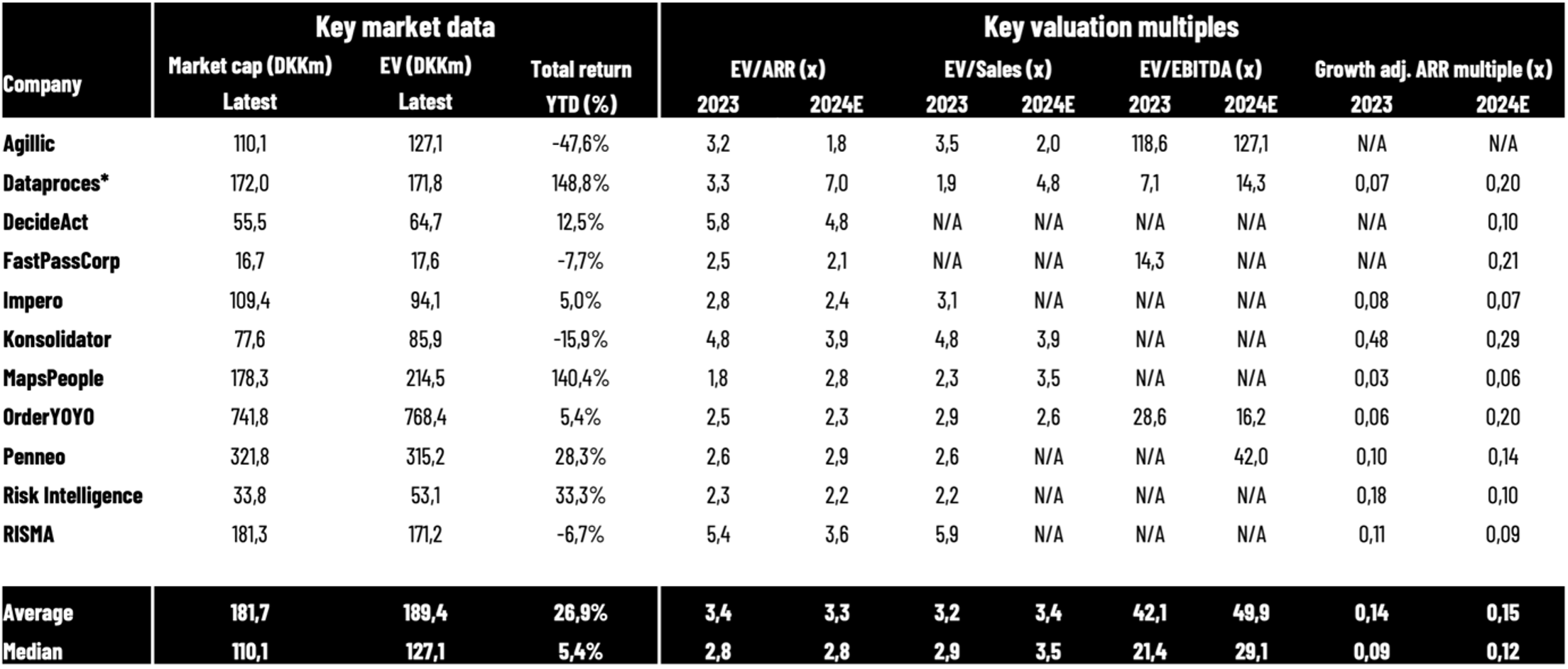

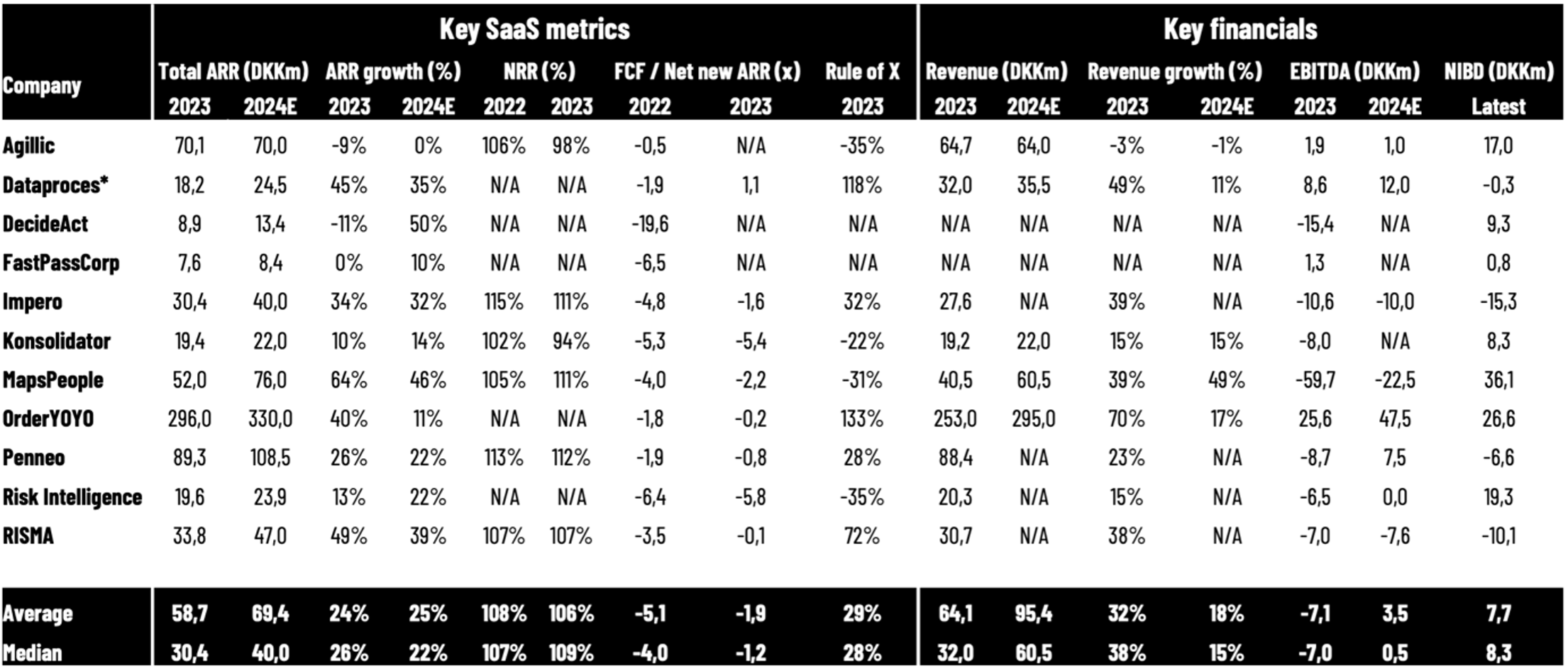

Overview of key metrics for Danish SaaS companies

We have collected data from 11 listed Danish SaaS companies. The overview will be updated on an ongoing basis. Market capitalizations are latest updated on 31 August 2024. Read the note below the tables for more detailed information.

Note: The table above summarizes key market data, key valuation multiples, key SaaS metrics, and key financials for Danish-listed SaaS companies reporting ARR (some software companies such as cBrain do not include ARR in their reporting and are not included). *Dataproces has a skewed/different accounting period than a regular calendar year. We apply the companies’ reported SaaS metrics, however, there are differences in the reporting methodologies, as there are no regulations or standards yet. When applying 2024E for the companies, we are using the companies’ guidance ranges (midpoint). We apply OrderYOYO’s pro forma net revenue in this overview (app smart consolidated full year) for both valuation multiples and growth rates. FCF/Net new ARR (2022) is calculated by taking FCF (cash flow from operations minus CAPEX, primarily investments in intangible assets) and the net ARR increase by the end of 2022 compared to the end of 2021. Penneo adjusts its FCF/Net new ARR ratio by DKK 2.4m due to costs related to the listing on the Main Market. Taking these costs out, the ratio will decline from -1.9x to -1.7x. In the calculation of net-interest-bearing debt (NIBD) for the companies in 2022, we have applied interest-bearing debt (including leasing liabilities) minus cash. This implies that negative values are companies with more cash than interest-bearing debt on their balance sheet. We apply the latest reported NIBD (for most companies) and market capitalizations from 31 December 2023 in our calculations of Enterprise Value multiples for 2023, and market capitalizations from 31 August 2024 for 2024E. MapsPeople’s net revenue retention rate (NRR) is based on MapsIndoors. All data is collected manually from reports, and we cannot guarantee the correctness of all data. Source: HC Andersen Capital and company reports.

Disclaimer: HC Andersen Capital receives payment from some of the mentioned SaaS companies (Agillic, Impero, MapsPeople, OrderYOYO, and Penneo) for a Digital IR/Corporate Visibility subscription agreement. All content in this newsletter is only for informational purposes. HC Andersen Capital cannot guarantee the correctness of all data in this newsletter.