As mentioned in the latest newsletter, some analysts expect that smaller and medium-sized companies will rebound in 2024, driven by increasing risk appetite after somewhat more “stable” macroeconomic data and due to the larger valuation gap between large-cap and small-cap companies. Looking across the Danish SaaS sector, there was a positive share price development as the average and median return was approx. 6% and 4%, respectively, in January 2024. This is also shown by some dominance of SaaS companies across the Danish stock market, as DecideAct, Impero, and MapsPeople all are present in the top 5 of the share price performances in Denmark year-to-date (here at the beginning of February 2024). In January 2024, some companies also reported new ARR numbers to the market, and one SaaS company was delisted. Put together, this implied that the median ARR multiple increased to 3.3x ARR by the end of January 2024 (from 3.0x ARR by the end of December 2023). Looking ahead into the upcoming months, both new financial guidance and management comments for 2024 – in connection with the annual reports for 2023 – will give us more data about the market development, sentiment, and what to expect.

Source: HC Andersen Capital and The SaaS Capital Index

Selected Danish SaaS news in January 2024 with preliminary results ahead of the earnings season

Starting with some sad news for us who love to follow listed SaaS companies, SameSystem had its last trading day in January 2024 following a voluntary delisting. As a consequence of the low share volume/liquidity and low market valuations, we have observed both delistings with companies being taken private voluntarily, as well as companies being acquired off the stock market at valuation multiples more than double up of the current median ARR valuation multiple.

In the upcoming months, the Danish SaaS companies are reporting their 2023 annual reports and new 2024 guidance. Some excitements of the 2023 results are taken out, as many companies have changed their guidance or reported their preliminary ARR and EBITDA numbers during January 2024. Penneo announced a preliminary ARR of DKK 89.3m by the end of 2023 (within its recent guidance range of DKK 87-92m), corresponding to a growth rate of approx. 26% YoY. EBITDA was upgraded to the range of DKK -10m to -8m (before DKK -15m to -10m). Similarly, Impero also announced its preliminary ARR within its recent guidance range and an upgraded EBITDA range. Impero’s preliminary ARR was DKK 30.4m by the end of 2023 (recent guidance range was DKK 29-33m), corresponding to a growth rate of 36% YoY, and its EBITDA range was upgraded to DKK -11m to -10m (before DKK -13m to -11m).

One of the top performers in 2023, OrderYOYO, continued its positive momentum, beating its latest 2023 guidance range on both ARR (annualized December MRR) and EBITDA before other extraordinary items. Additionally, OrderYOYO also upgraded its 2024 guidance range significantly and now expects December ARR 2024 of between DKK 315-325m and EBITDA between DKK 33-38m in 2024.

Looking into 2024, the most attention in the upcoming annual reports will be directed towards the new guidance for 2024. This will shed light on the market development as well as the companies’ strategy, including growth vs. profitability/cash efficiency. Below, we have provided an overview of the SaaS companies, the date of the annual report, and some overview of the expected 2023 ARR (preliminary announced ARR) and expected 2023 EBITDA (preliminary announced EBITDA). Note that the numbers are from the end of January 2024, and there may have been changes since.

Source: HC Andersen Capital and company reports (manually collected)

Rule of X – tradeoff between growth vs. profitability

We have discussed the tradeoff between growth vs. profitability heavily. This has been a theme after the higher interest rate environment has put pressure on capital markets and access to new capital. Concerning this tradeoff, Bessemer Venture Partners (BVP) have introduced ‘Rule of X’ as an alternative to the more common ‘Rule of 40’ (revenue growth + FCF margin should equal +40%) in a new article. BVP’s take is that – in conjunction with other research that we are tracking – growth needs to remain the primary priority for businesses. According to the BVP article (https://www.bvp.com/atlas/the-rule-of-x), long-term models show that growth should be valued at least 2-3x more than the FCF margin. The reason is that a growth rate increase can have a compounding impact on value. In other words, a company with a 30% growth rate and a 15% FCF margin should be valued higher than a company with a 15% growth rate and a 30% FCF margin. The formula is: Rule of X = (Growth Rate x Multiplier*) + FCF margin. *Multipler on growth rate is approx. 2x for private companies and approx. 2-3x for public companies. However, BVP highlights that the application of Rule of X is less good for early-stage private companies which are growing more than 125% and burning more than 75%.

In the article, BVP highlights Snowflake as an “extreme example”, since the yield has been impressive, and the company is still growing at high growth rates. The company burned USD +1bn before becoming FCF profitable in FY 2022, and the IPO market cap after the first day of trading was approx. USD 70bn, demonstrating the massive return over time.

If the Rule of X with more weight on growth gets hold of investors after a period of more focus on profitability and cash flows, this could somewhat support the more growth-oriented Danish SaaS companies. However, this is – of course – also dependent on other factors for the Danish SaaS companies (many of them are still in earlier lifecycle stages), including access to new capital, which may be the most important factor in the current environment.

First 2024 signs from the US/global SaaS sector

The global SaaS company, ServiceNow, is always one of the first public US SaaS companies to report earnings. ServiceNow increased its net new ARR in Q4 2023 (change in ARR from one quarter to the next) which somewhat supports the “not getting worse, and maybe getting slightly better” narrative about the macro situation, as the newsletter Clouded Judgement by Jamin Ball highlights. Reports and comments on the investor call from the three cloud giants (Microsoft – Microsoft Azure, Amazon – AWS, and Alphabet – Google Cloud) somewhat indicate the same, i.e. the impact from cost optimization is diminishing, and new workloads are driving growth.

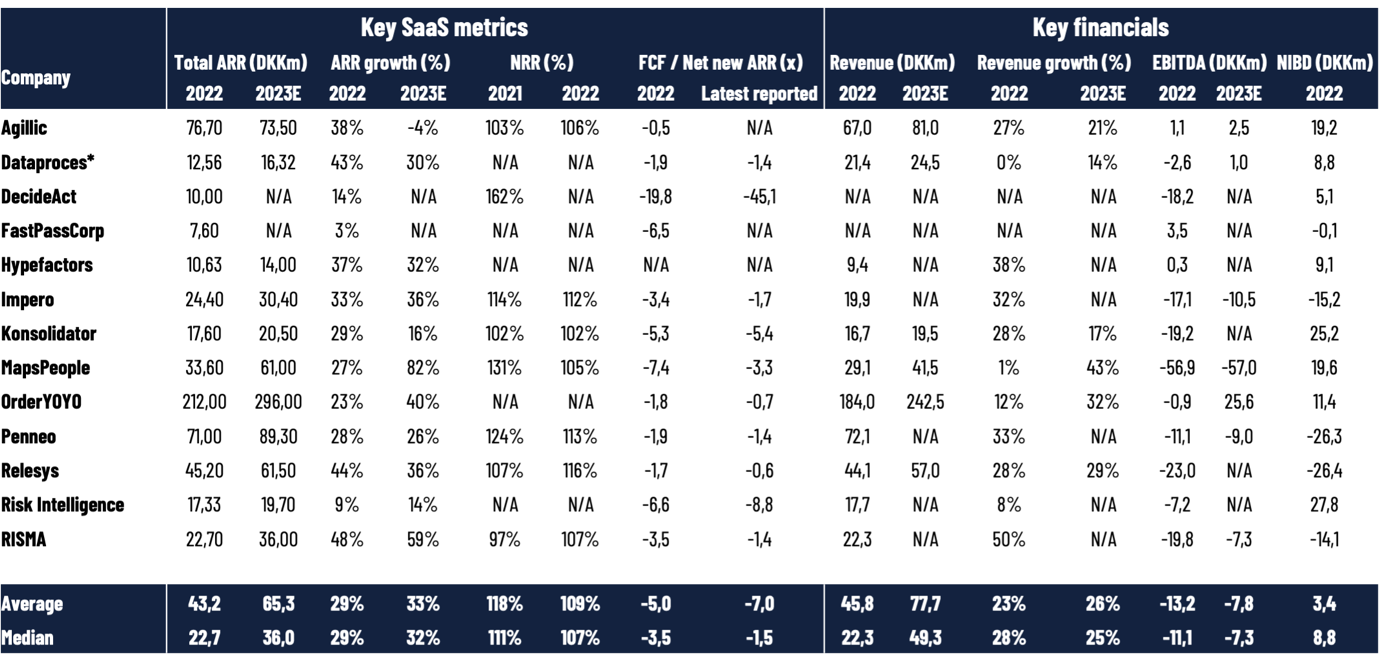

Overview of key metrics for Danish SaaS companies

We have collected data from 13 listed Danish SaaS companies. The overview will be updated on an ongoing basis. Market capitalizations are latest updated on 31 January 2024. Read the note below the tables for more detailed information.

Note: The table above summarizes key market data, key valuation multiples, key SaaS metrics, and key financials for Danish-listed SaaS companies reporting ARR (some software companies such as cBrain do not include ARR in their reporting and are not included). *Dataproces has a skewed/different accounting period than a regular calendar year. We apply the companies’ reported SaaS metrics, however, there are differences in the reporting methodologies, as there are no regulations or standards yet. When applying 2023E for the companies, we are using the companies’ guidance ranges (midpoint) or reported/preliminary numbers. We apply OrderYOYO’s pro forma net revenue in this overview (app smart consolidated full year) for both valuation multiples and growth rates. FCF/Net new ARR (2022) is calculated by taking FCF (cash flow from operations minus CAPEX, primarily investments in intangible assets) and the net ARR increase by the end of 2022 compared to the end of 2021. Penneo adjusts its FCF/Net new ARR ratio by DKK 2.4m due to costs related to the listing on the Main Market. Taking these costs out, the ratio will decline from -1.9x to -1.7x. In the calculation of net-interest-bearing debt (NIBD) for the companies in 2022, we have applied interest-bearing debt (including leasing liabilities) minus cash. This implies that negative values are companies with more cash than interest-bearing debt on their balance sheet by the end of 2022. We apply the latest reported NIBD (for most companies) and market capitalizations from 31 January 2024 in our calculations of Enterprise Value multiples for 2023E, implying that we have used the latest reported numbers (preliminary Q4 2023, Q3 2023, or H1 2023 numbers). MapsPeople’s net revenue retention rate (NRR) is based on MapsIndoors. All data is collected manually from reports, and we cannot guarantee the correctness of all data. Source: HC Andersen Capital and company reports.

Appendix: We are fully aware that no SaaS companies have similar business models or similar reporting standards, as there are no regulated standards yet for SaaS metrics such as ARR, net revenue retention rate, etc. Nevertheless, we do not have any public information to align all metrics, implying that we must use the metrics reported by the companies in their annual reports. Consequently, our information and benchmark data should be assessed carefully before making any conclusions or decisions. That said, we are active in a working group that provides recommendations for how to measure and report the metrics to investors in the most appropriate way.

The HCA SaaS Index: Our HCA SaaS Index is inspired by the US-based The SaaS Capital Index, which tracks the median ARR (latest reported annualized current run-rate revenue) multiple across US-listed B2B software companies based on their market capitalizations by the end of the month. This implies that there are timing variations in the latest reported ARR, and the multiples do not account for differences in cash position and debt structure. Please be aware that the US-listed companies are typically significantly larger companies with a global presence than the companies that we are tracking in Denmark. Despite the ongoing focus on profitability as well as capital efficiency and not only growth, SaaS companies are still valued on a multiple of their ARR or revenue. Currently, this is the most relevant multiple to compare across the sector since most SaaS companies are not profitable yet.

Disclaimer: HC Andersen Capital receives payment from some of the mentioned SaaS companies (Agillic, Impero, MapsPeople, OrderYOYO, and Penneo) for a Digital IR/Corporate Visibility subscription agreement. All content in this post is only for informational purposes. HC Andersen Capital cannot guarantee the correctness of all data in this post.