New potential takeover in Denmark and rebound in the US SaaS sector

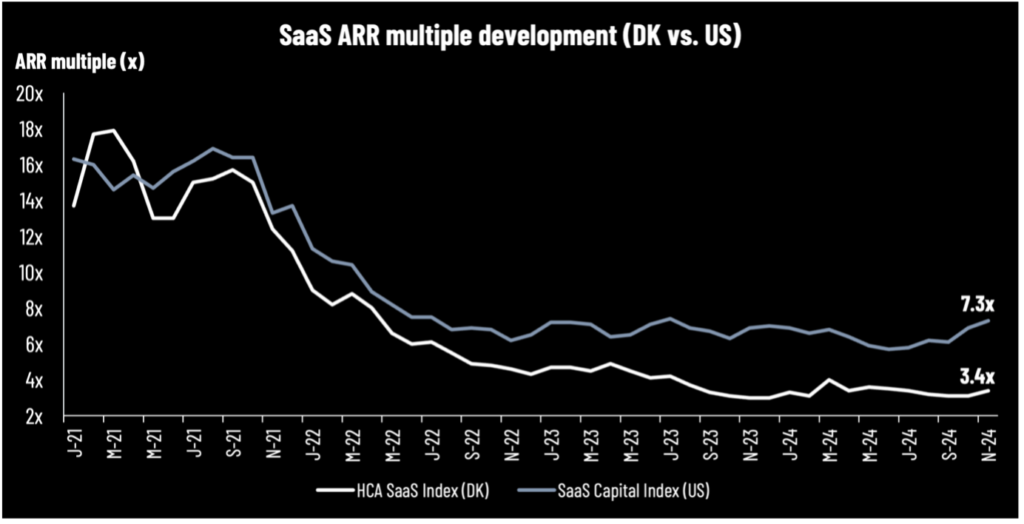

With the strong momentum in the global SaaS sector in November, the median ARR multiple from the SaaS Capital Index has increased to 7.3x by the end of November 2024. The sector’s share price increase is shown by e.g. the WisdomTree Cloud Computing ETF with an increase of approx. 18% in November, and the momentum is continued into the beginning of December.

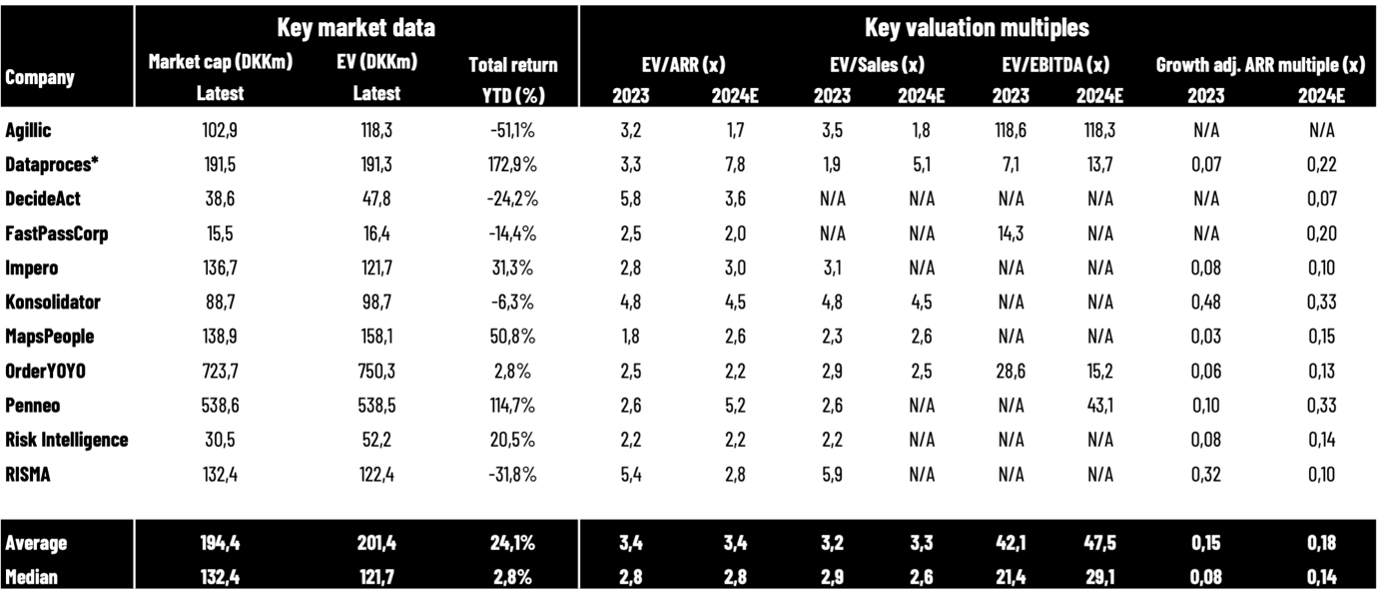

Despite an increase to a median ARR multiple of 3.4x in the Danish SaaS sector (from median of 3.1x ARR in October), the valuation gap is still high, and the same optimism as in the US SaaS sector has not been seen in the Danish SaaS sector yet.

Expected Penneo takeover takes the headlines

With Visma’s voluntary recommended public takeover offer (no official offer document yet) to purchase all shares in Penneo for approx. DKK 562m (DKK 16.50 per share, a premium of approx. 110%), the Danish SaaS sector of listed companies may lose one of its most known companies after the company was listed in the summer of 2020 at DKK 11.06 per share.

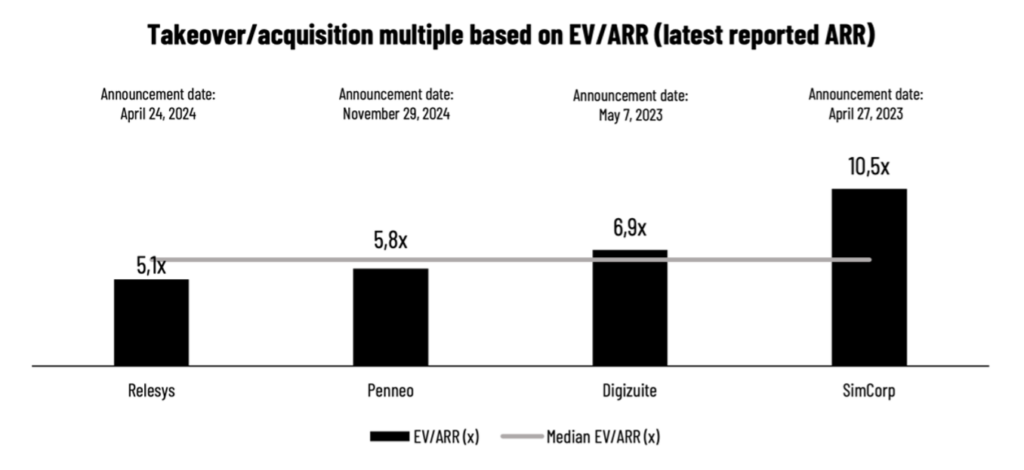

Looking at the valuation multiple of the expected takeover/acquisition, this is approx. 5.8x EV/ARR (latest reported Q3 ARR), above the recent transaction from Relesys 5.1x EV/ARR, but below the acquisition from last year of Digizuite which was acquired for 6.9x EV/ARR. Below, we have also included SimCorp, acquired for approx. 10.5x EV/ARR.

Across Penneo’s shareholder base, approx. 52.9% have either entered into irrevocable undertakings or confirmed their intention to accept the offer. However, the offer price needs acceptance from more than 90% to be completed.

Q3 2024 deep dive in the Danish SaaS Sector

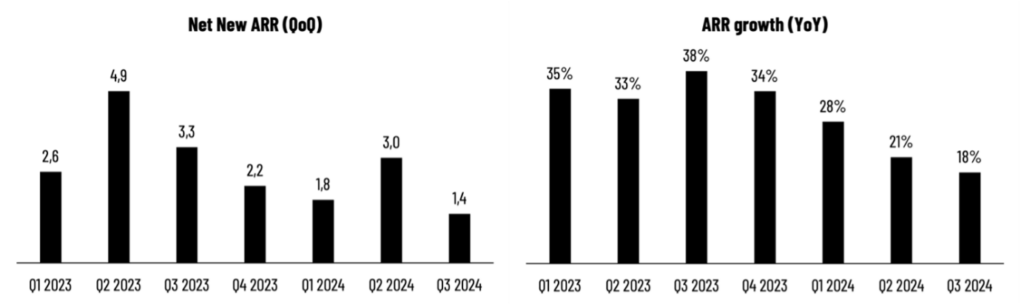

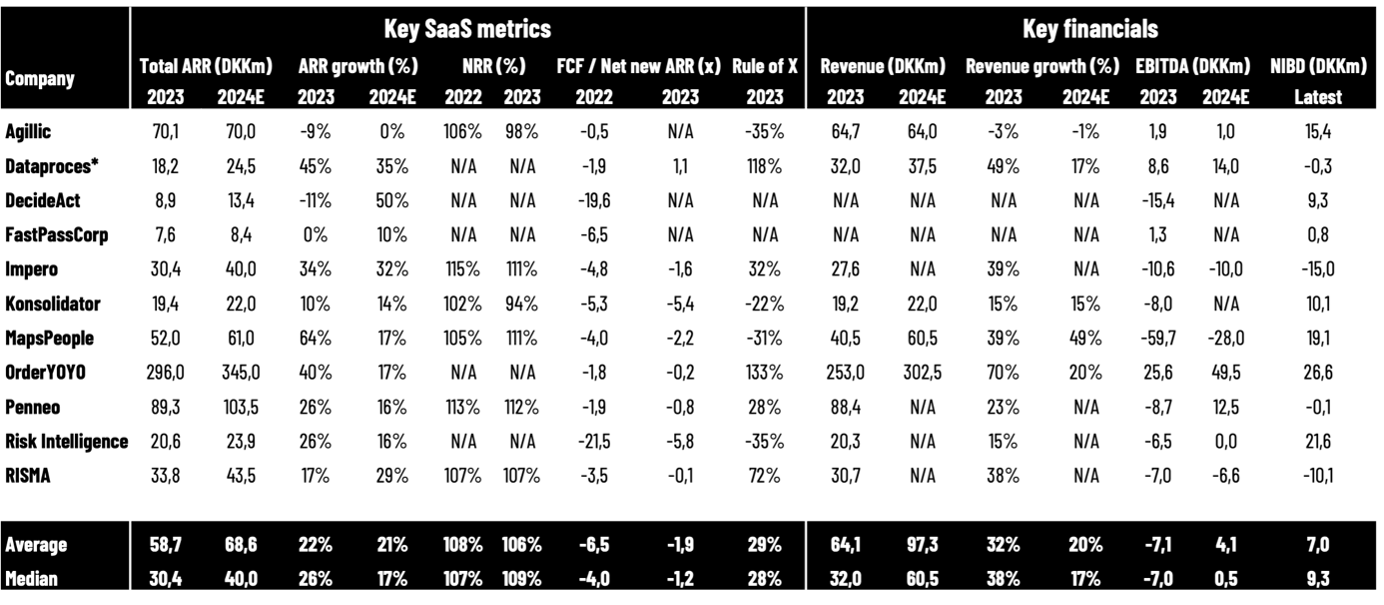

Summarizing the Danish SaaS Q3 earnings season with new reports coming out from November, Q3 has been a difficult quarter. We often see the effects of summer/vacation and decisions being postponed to Q4 (Q4 is normally the strongest quarter for enterprise SaaS sales). Despite a challenging quarter for many companies, Impero, accelerated its ARR growth in Q3. As shown below, the median net new ARR QoQ (Q3 2024) was at a very low level of DKK 1.4m. In conjunction with this picture, the ARR growth (YoY) is at the lowest level we have seen at 18% YoY, down from 21% YoY in Q2 2024.

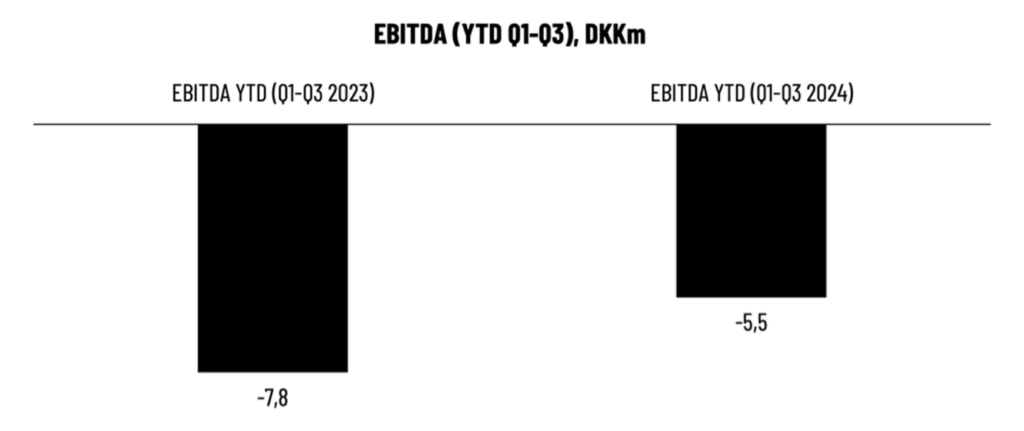

With the ARR growth rates (median) in a downward direction, this may not only be explained by a weaker market environment. Several SaaS companies have also allocated less capital and investments into growth activities to become more cost and capital efficient, which have had a positive effect on profitability (EBITDA). Looking at the median EBITDA Q3 YTD results, there has been an improvement to DKK -5.5m (Q1-Q3 2024 YTD) from DKK -7.8m (Q1-Q3 2023 YTD).

Penneo downgraded its 2024 ARR guidance in connection with the Q3 2024 report. The company now expects growth in the range of 13-19% by the end of 2024. However, Penneo upgraded its 2024 EBITDA guidance range from DKK 5-10m to DKK 10-15m. In Q3 2024, Penneo’s ARR growth rate was 18% YoY. The company increased its profitability and cash flow focus, demonstrated by improving its EBITDA (and the upgraded guidance level) and delivering a positive cash flow from operations in Q3 2024 YTD.

As mentioned above, however, it was Visma’s later-announced all-cash voluntary recommended public takeover offer on Penneo which took the headlines and was the story of month.

Watch Penneo’s Q3 2024 management presentation here.

Impero delivered a strong Q3 2024 with continued momentum in the DACH region. The company’s ARR growth rate was 31% YoY by the end of Q3 2024, and net revenue retention rate of 109% (including a continued low churn rate of 4%). Impero has also improved its profitability and delivered positive cash flow from operating activities in Q3 2024 YTD. Impero kept its 2024 guidance with ARR in the range of DKK 38-42m by the end of 2024 (25-38% YoY growth) and EBITDA in the range of DKK -11m to -9m for the full year 2024. Impero’s EBITDA Q3 2024 YTD is DKK -6.7m and thus on track to deliver within or better than the guidance range.

Watch Impero’s Q3 2024 management presentation here.

MapsPeople updated their 2024 guidance in connection with the Q3 2024 results. The ARR guidance was changed from the range of DKK 72-80m to the range of DKK 59-63m by the end of 2024, corresponding to a growth rate in the range of 14-21% YoY. Revenue guidance was kept at DKK 58-63m (43-55% YoY growth). The EBITDA before special items guidance was downward adjusted to between DKK -30m to -26m (before between DKK -25m to -20m) due to additional costs than initially expected. By the end of Q3 2024, ARR was DKK 56.2m (9% YoY growth).

Watch MapsPeople’s Q3 2024 management presentation here.

In Q4, MapsPeople’s growth will be positively affected by the recent acquisition of Point Consulting’s indoor mapping customer contracts and associated technology, adding a new ARR of DKK 2.4m and thus put MapsPeople’s ARR close to the low end of the guidance range.

RISMA ended Q3 2024 with a total ARR of DKK 39.2m, corresponding to a growth rate of 29% YoY. The company’s ARR guidance is DKK 42-45m by the end of 2024, corresponding to an ARR growth rate in the range of 24-33% YoY. In 2024, EBITDA is expected to be between DKK -8.6m and -4.6m.

Konsolidator also reported its Q3 2024 results, ending the quarter with an ARR of DKK 20m, corresponding to an ARR growth rate of 7% ARR YoY. The 2024 outlook is ARR and revenue in the range of DKK 21-23m (requires new sales in one of its new business segments), and an EBIT loss between DKK -12m and -10m.

Other SaaS news from the Danish SaaS sector in November

Besides recent takeovers on Digizuite, Relesys, and potentially also Penneo with the recent news, there could be more acquisitions and delistings on the way. In November, DecideAct also announced that a US-listed company is expected (signed a letter of intent) to acquire a minimum of 51% of the company’s shares (convert DecideAct shares into shares in the US company). This may not lead to a full acquisition and delisting afterwards, but it could be the first step. Despite the announcement of an offer being delayed, an offer on DecideAct could take focus in the beginning of 2025.

In November, it was also announced that Agillic’s CFO will leave the company by the end of February 2025.

Strong momentum in the global/US SaaS sector driven by solid results and AI

Across the broader global/US SaaS sector, software shares rebounded significantly. Despite ARR multiples below the long-term average, the growth-adjusted multiples, however, look very expensive as highlighted by Clouded Judgement (Jamin Ball). One of the key reasons for the recent share price increase in the global SaaS sector is the improvement in the SaaS companies’ profitability and FCF. According to Clouded Judgement (Jamin Ball), Q3 was also the strongest over the past 3 years for the US/global SaaS sector.

AI may also explain the recent momentum and rotation into the global SaaS sector, which somewhat has stopped the AI-kills-software thesis. According to Goldman Sachs, the AI boom is divided into different phases; 1) semiconductor (Nvidia), 2) infrastructure (Microsoft, Amazon, Alphabet/Google), and 3) AI software. The third phase has played out recently, as Goldman Sachs has highlighted that there has been a rotation from Mag7 stocks to AI software stocks in Q3; the first quarter with this rotation.

Overview of key metrics for Danish SaaS companies

We have collected data from 11 listed Danish SaaS companies. The overview will be updated on an ongoing basis. Market capitalizations are latest updated on 30 November 2024. Read the note below the tables for more detailed information.

Note: The table above summarizes key market data, key valuation multiples, key SaaS metrics, and key financials for Danish-listed SaaS companies reporting ARR (some software companies such as cBrain do not include ARR in their reporting and are not included). *Dataproces has a skewed/different accounting period than a regular calendar year. We apply the companies’ reported SaaS metrics, however, there are differences in the reporting methodologies, as there are no regulations or standards yet. When applying 2024E for the companies, we are using the companies’ guidance ranges (midpoint). We apply OrderYOYO’s pro forma net revenue in this overview (app smart consolidated full year) for both valuation multiples and growth rates. FCF/Net new ARR (2022) is calculated by taking FCF (cash flow from operations minus CAPEX, primarily investments in intangible assets) and the net ARR increase by the end of 2022 compared to the end of 2021. Penneo adjusts its FCF/Net new ARR ratio by DKK 2.4m due to costs related to the listing on the Main Market. Taking these costs out, the ratio will decline from -1.9x to -1.7x. In the calculation of net-interest-bearing debt (NIBD) for the companies in 2022, we have applied interest-bearing debt (including leasing liabilities) minus cash. This implies that negative values are companies with more cash than interest-bearing debt on their balance sheet. We apply the latest reported NIBD (for most companies) and market capitalizations from 31 December 2023 in our calculations of Enterprise Value multiples for 2023, and market capitalizations from 30 November 2024 for 2024E. MapsPeople’s net revenue retention rate (NRR) is based on MapsIndoors. All data is collected manually from reports, and we cannot guarantee the correctness of all data. Source: HC Andersen Capital and company reports.

Disclaimer: HC Andersen Capital receives payment from some of the mentioned SaaS companies (Agillic, Impero, MapsPeople, OrderYOYO, and Penneo) for a Digital IR/Corporate Visibility subscription agreement. All content in this newsletter is only for informational purposes. HC Andersen Capital cannot guarantee the correctness of all data in this newsletter.