Recent news from the Danish SaaS sector

Agillic was the first Danish SaaS company to report its Q3 2023 report in October, while the rest of the Danish SaaS sector will report in November. Agillic continues its focus on sustainable growth and operational excellence, shown by its positive EBITDA, reaching DKK 3.5m in the first nine months of 2023 (DKK -0.3m in the same period in 2022). The year-to-date EBITDA level is in the upper end of Agillic’s EBITDA 2023 guidance range of DKK 1-4m. Agillic’s total ARR declined -1% YoY due to a decline in SMS transactions from global price increases (ARR transactions were -38% YoY). The decline in ARR transactions was offset by an increase in ARR subscriptions, growing 13% YoY. Watch the full Q3 2023 presentation with Agillic’s management here.

OrderYOYO also reported its Q3 2023 trading update earlier in October. Following successful acquisitions and a large focus on profitability, the company delivered a positive Cash EBITDA in all months in Q3. OrderYOYO delivered a total ARR of DKK 256m by the end of Q3 2023, corresponding to a growth rate of 38% YoY. Net revenue over the first nine months of 2023 (pro forma) was in line with this, growing 37% YoY. Moreover, the company released its 2024 guidance and expects to further increase its profitability level measured by EBITDA before other extraordinary items to between DKK 23-28m (2023 guidance is now DKK 20-23m). As a result of OrderYOYO’s strong performance, the company raised its guidance for the fourth time. Watch the management presentation here.

Looking into November and the rest of the Q3 earnings season in Denmark, investors may be looking for differences in the growth picture, as we see large differences across end markets. This is also shown in the large volatility following new reports from US-listed global SaaS companies. Moreover, the deceleration of growth rates combined with higher interest rates and negative earnings have been a bad cocktail across the US-listed SaaS companies when looking into the worst-performing shares following their Q3 2023 reports.

Large volatility across global SaaS companies

Across the global US SaaS sector, we have already seen huge volatility following recent Q3 2023 reports. Results with relatively small deviations from guidance and/or lower-than-expected forward guidance have led to massive declines for stocks such as Confluent (data infrastructure) of approx. -42% and Paycom Software (HR and payroll services) of approx. -39%. Currently, the market also punishes non-profitable / negative FCF margin companies if growth rates continue to decelerate to current or expected levels that are not associated with a “growth stock”. Thus, global SaaS companies with declining growth rates and no clear visibility yet of being cash-flow generating and profitable have experienced massive share price drops following their Q3 report.

On the other hand, Palantir Technologies (AI and big data software platform) was able to beat expectations on both revenue and net income, and, more importantly, its forward guidance was also above market expectations. As a result, the share jumped approx. 20%. Shopify (e-commerce platform) also jumped approx. 22% after exceeding expectations for both revenue and earnings.

Fresh financial reports from cloud giants

Looking at the three cloud giants – Google Cloud, Microsoft Azure, and Amazon Web Services – the main focus was on comments that could support news of a potential re-acceleration of growth rates in Q3 2023 and into Q4 2023. However, numbers did not give a clear picture; Amazon’s AWS grew 12% YoY, similar to the quarter before, Microsoft Azure grew 28% YoY in constant currencies, a small increase from 27% in the recent quarter, while Google Cloud was the loser, growing 22% YoY from 28% YoY in the recent quarter.

Thus, Microsoft Azure delivered the most positive results among the three cloud giants. Not surprisingly, Microsoft’s Azure growth was driven by higher-than-expected AI consumption that contributed to the revenue growth.

Interest rates continued to put pressure on valuations – but a favorable reversal in interest rates recently

Increasing interest rates continued to make negative headlines and put pressure on SaaS valuations, as the US 10Y bond yield climbed to approx. 5% in the middle of October. Combined with the fact that there are no clear signs of growth re-acceleration across the SaaS sector, key headwinds are still challenging the sector’s valuation.

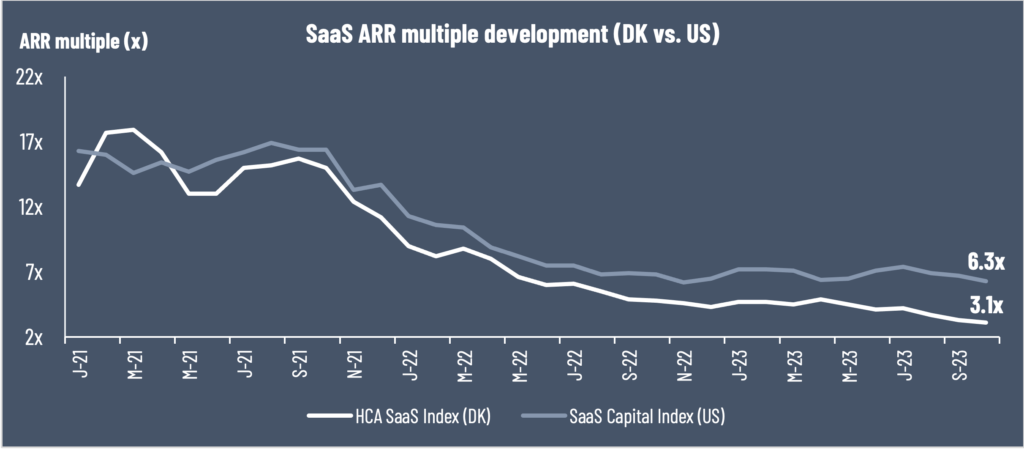

Focusing on the Danish SaaS sector, we saw a decline from 3.3x ARR (end September 2023) to 3.1x ARR (end October 2023). This was negatively affected by the acquisition/delisting of SimCorp (traded at a higher ARR multiple of 10.5x) which was removed from the index in October. Comparing the Danish SaaS sector to the US SaaS sector, we still see a large valuation gap, yet the US SaaS sector did also decline based on a median multiple of 6.3x (end October 2023), down from 6.7x ARR (end September 2023).

Looking more positively on an overall level, market analysts are currently discussing a year-end stock market rally. This has been somewhat reinforced by a decline in the US 10Y bond yield to 4.6% here at the beginning of November (time of writing this newsletter). If this is the time when interest rates are topping out, many analysts expect to see an increasing valuation multiple on an overall level going forward, also affecting interest-rate sensitive SaaS shares.

Source: HC Andersen Capital and The SaaS Capital Index