As mentioned in the newsletter covering October, the negative sentiment in the stock market was significant. Following several months of stock market losses after increasing interest rates and several macro uncertainties, a sudden change could open up a year-end stock market rally. This scenario played out in November, as the interest rate measured by the US 10Y bond yield declined from nearly 5.00% at the end of October 2023 to below 4.30% at the end of November 2023. Now, markets expect that the Fed’s rate hikes have come to an end, which is good news for the SaaS sector – especially if the global economy does not see a sharp slowdown.

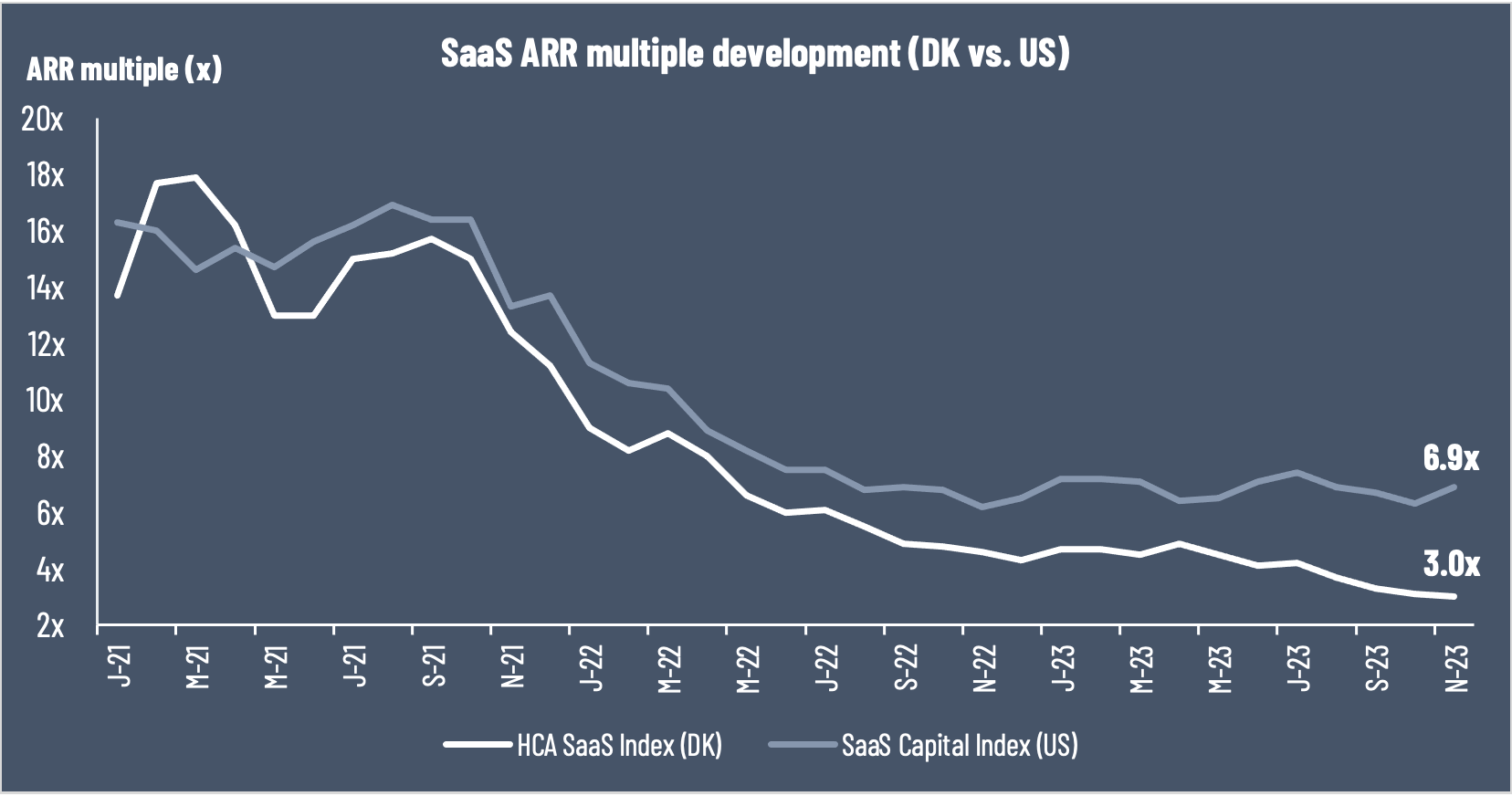

The positive sentiment has also driven an increase in the US SaaS sector median valuation multiple, as the ARR multiple increased significantly to 6.9x ARR (from 6.2x ARR by the end of October) according to The SaaS Capital. In contrast, the median ARR multiple across the Danish SaaS sector declined to 3.0x ARR (from 3.1x ARR by the end of October), as there were no big positive surprises in the Q3 2023 earnings season. In the next sections, we will look more into the earnings season in Denmark and globally, respectively.

Source: HC Andersen Capital and The SaaS Capital Index

Update on the Danish Q3 2023 earnings season and recent news

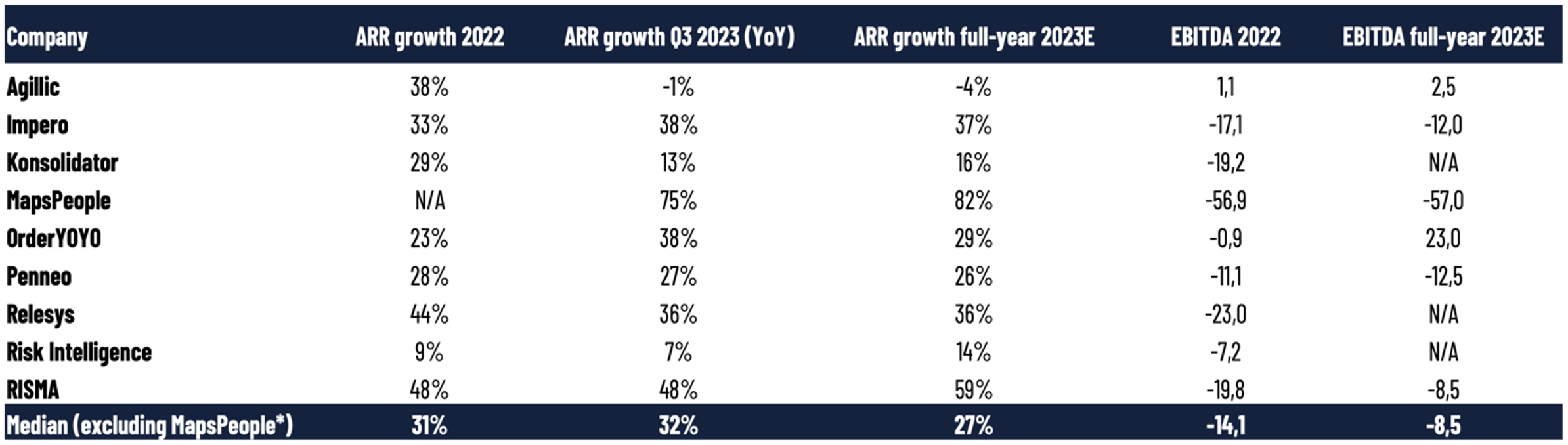

Most of the Danish SaaS companies reported their Q3 results in November 2023. We have earlier highlighted the importance of capital efficiency as well as the focus on profitability in the current market environment. In line with this, the selected Danish SaaS companies expect to improve their EBITDA in 2023 vs. 2022 based on the guidance midrange for 2023 (reported median of DKK -14.1m in 2022 vs. median of DKK -8.5m in 2023). However, growth is still a driving factor for SaaS companies. As shown in the table below, the Danish SaaS companies seem to be ahead of the full-year guidance midrange (Q3 2023 median growth rate of 32% vs. 27% expected growth for the full-year 2023 based on midrange). It should be noted that not all Danish SaaS companies report Q3 2023 results. The table below provides an overview of the overall development in the sector as well as expectations for 2023 based on 9 Danish SaaS companies.

*MapsPeople is excluded for ARR growth numbers, as we do not have a comparable ARR growth rate in 2022 following a change in the way of reporting ARR.

Looking into Q3 2023 results, Agillic, Impero, OrderYOYO, and Penneo delivered better YoY ARR growth rates in Q3 than their latest updated ARR growth guidance range (midrange) by the end of 2023. On the other hand, Konsolidator, MapsPeople, Risk Intelligence, and RISMA must accelerate their ARR growth in the last quarter of 2023 compared to the same quarter last year to reach their full-year 2023 ARR guidance. Relesys’ ARR growth of 36% YoY in Q3 2023 was in line with the expected ARR growth by the end of 2023 based on its guidance midrange.

There were no big surprises in the growth picture in Q3 2023 across the sector. In November, Penneo reported its strongest Q3 to date (typically a low season for Penneo) on net new ARR, but the company reduced the top of its ARR guidance range by the end of 2023 to DKK 87-92m (before DKK 87-95m). OrderYOYO acquired a German online ordering company, Gustoco (transaction value of approx. DKK 8.8m and ARR of approx. DKK 4m) and raised its ARR guidance for the fifth time this year to the range of DKK 270-275m (before DKK 260-270m).

Other news coming out of the Danish SaaS sector included that Impero raised gross proceeds of DKK 10m in new capital from a private placement for continued growth investments following a positive development in its capital efficiency. MapsPeople has also raised gross proceeds of DKK 8.5m in new capital from a private placement, which is a part of a total capital requirement of DKK 15-20m to finance its operations in 2023 and into 2024 before expectations of achieving a point of cash flow break-even in 2024.

First positive signs from the US SaaS sector

Across the US SaaS sector, we have also seen that most of the global companies have reported their results in the current earnings season. According to Clouded Judgement (Jamin Ball), the median net new ARR YoY growth in Q3 2023 was positive for the first quarter since Q2 2022. Thus, companies’ significant cost optimizations on software vendors could now be over in the current cycle. Combined with the potential declining inflation and interest rates looking into 2024, these could be the first signs that software headwinds (finally) have bottomed out. However, it is still too early to draw any conclusions.

As commented on in the recent October update, we are still seeing large stock market movements, even on slight deviations in reported results or expectations compared to analyst consensus estimates. Overall, there have been more ups than downs, as the US SaaS sector has developed positively over the last month. Even though positive signs are coming out of the global/US SaaS sector when looking at the results, the main factor behind the positive stock market development in November has been the rising expectations of massive interest rate cuts in 2024.