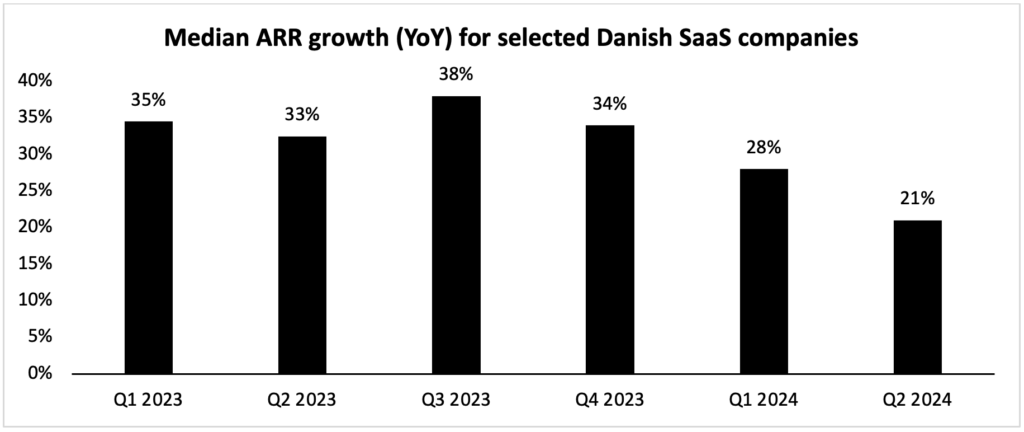

Growth concerns continue in the SaaS sector

Despite the focus on profitable growth also shown by improved EBITDA results and better cash efficiency, the growth rate development trend is still going in the wrong direction, both in the US/global SaaS sector and the Danish SaaS sector. In the US, the median Q2 revenue growth was 15% YoY, while the Danish companies (smaller in size) grew ARR by a median of 21% YoY.

Source: HC Andersen Capital and company reports. The median is calculated across the following companies: Agillic, Impero, Konsolidator, MapsPeople, OrderYOYO, Penneo, and RISMA.

Despite some optimism into H2 across the Danish sector based on guidance ranges and comments, we have seen a downgrade here in September from the GRC software provider, RISMA, now guiding ARR of DKK 42-45m (24-33% YoY) by the end of 2024, down from before DKK 45-49m (33-45% YoY). Nevertheless, the midpoint in the new ARR guidance range is still above the Danish sector median (median of 22% YoY for 2024E). However, RISMA’s 2024 EBITDA guidance was upgraded to between DKK -8.6m and DKK -4.6m (before DKK -9.6m and DKK -5.6m) due to expected lower costs.

According to Clouded Judgement (Jamin Ball), one of the top Q2 2024 financial performers in the US SaaS sector is Olo, which is an American-based online ordering platform for restaurants. The company is considered to be a US big brother to the Danish-listed SaaS company, OrderYOYO, which also provides ordering, payment, marketing software, and POS solutions to takeaway restaurants in Europe. However, looking at share price performance, the share prices are still down YTD. Olo is down approx. -19% YTD, and OrderYOYO is down approx. -4% YTD.

Macro is still a challenge

On an overall level, the current uncertain geopolitical and economic environment remains, also driven by the recent escalation between Israel and Hezbollah in the Middle East. This may affect the willingness to invest in new solutions to some extent. However, as highlighted in the former newsletter, 2024 could be more backend loaded with more tech and SaaS investments by the end of the year after hesitant buyers during the year.

From a valuation perspective, SaaS valuations have also been challenged by an increasing US 10Y bond yield, climbing above 4.00% at the beginning of October. This somewhat limits the risk appetite for growth stocks such as SaaS companies.

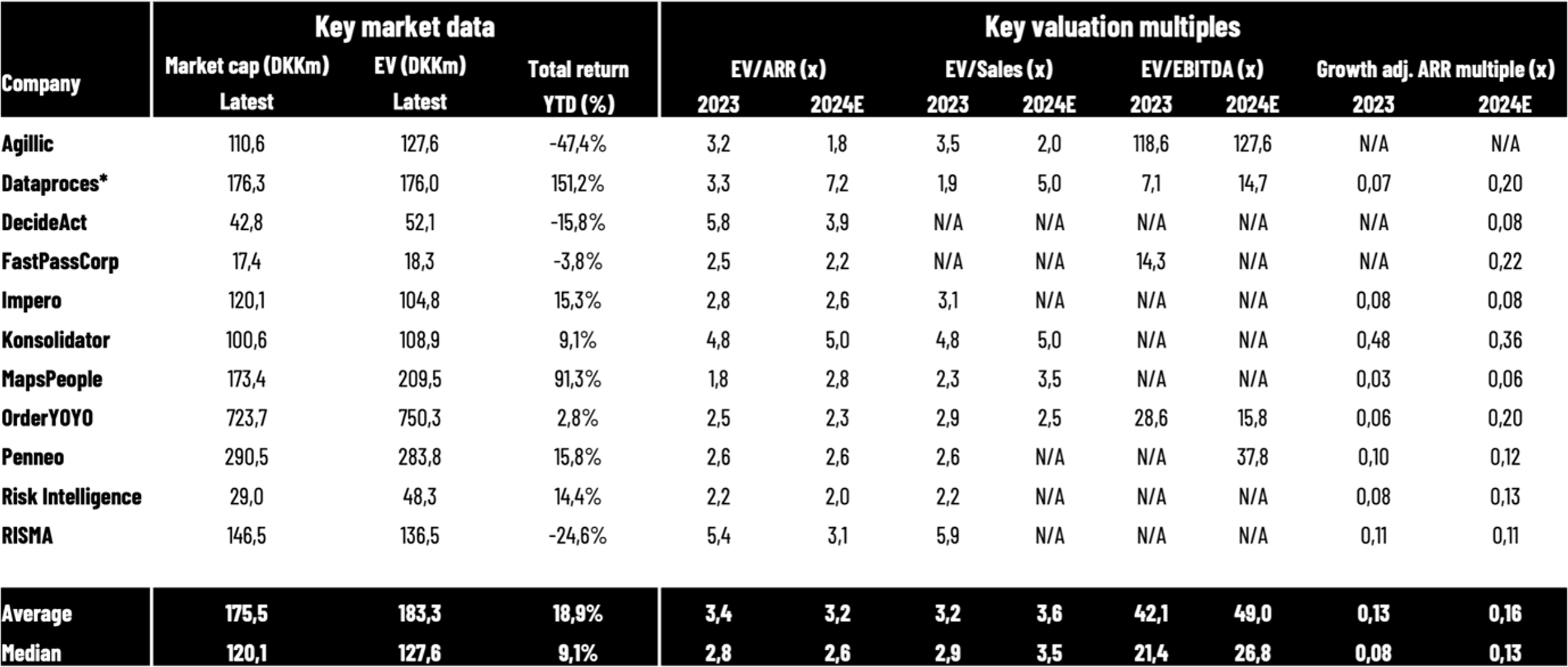

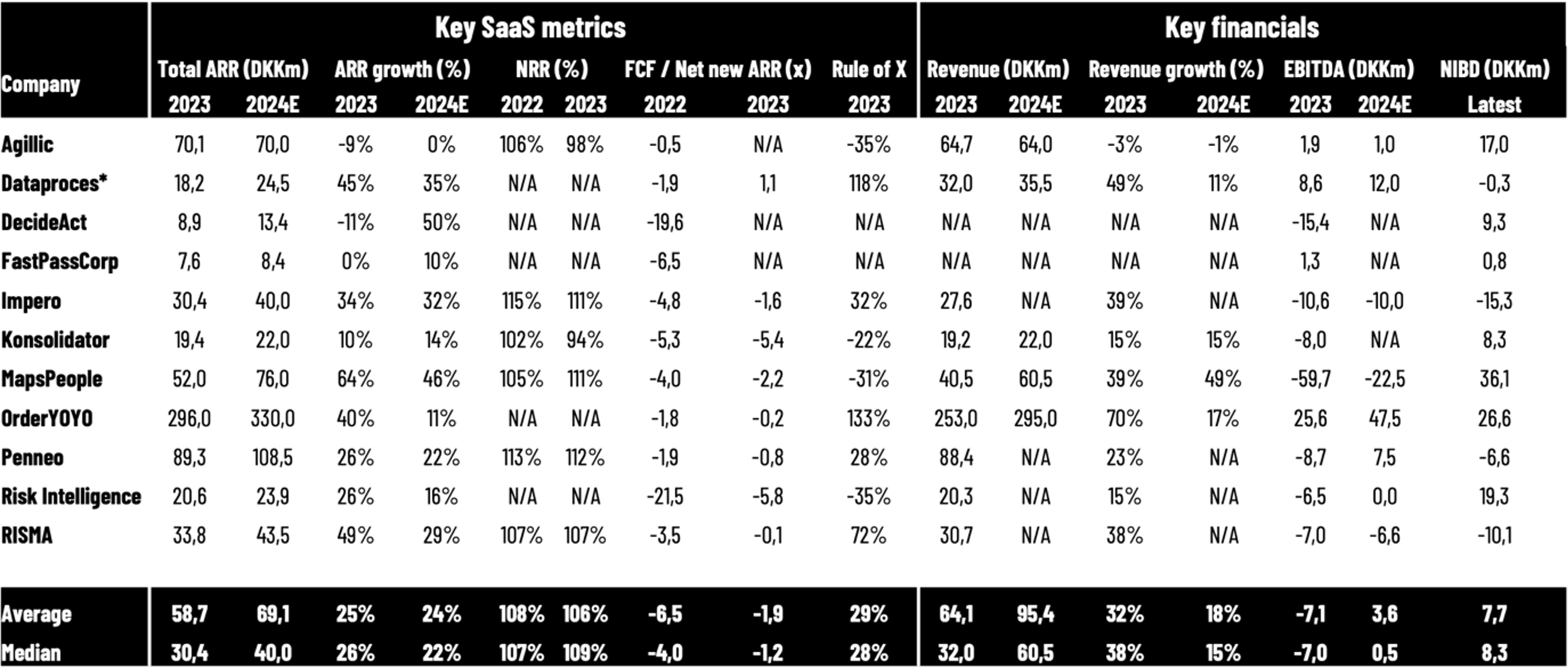

Overview of key metrics for Danish SaaS companies

We have collected data from 11 listed Danish SaaS companies. The overview will be updated on an ongoing basis. Market capitalizations are latest updated on 30 September 2024. Read the note below the tables for more detailed information.

Note: The table above summarizes key market data, key valuation multiples, key SaaS metrics, and key financials for Danish-listed SaaS companies reporting ARR (some software companies such as cBrain do not include ARR in their reporting and are not included). *Dataproces has a skewed/different accounting period than a regular calendar year. We apply the companies’ reported SaaS metrics, however, there are differences in the reporting methodologies, as there are no regulations or standards yet. When applying 2024E for the companies, we are using the companies’ guidance ranges (midpoint). We apply OrderYOYO’s pro forma net revenue in this overview (app smart consolidated full year) for both valuation multiples and growth rates. FCF/Net new ARR (2022) is calculated by taking FCF (cash flow from operations minus CAPEX, primarily investments in intangible assets) and the net ARR increase by the end of 2022 compared to the end of 2021. Penneo adjusts its FCF/Net new ARR ratio by DKK 2.4m due to costs related to the listing on the Main Market. Taking these costs out, the ratio will decline from -1.9x to -1.7x. In the calculation of net-interest-bearing debt (NIBD) for the companies in 2022, we have applied interest-bearing debt (including leasing liabilities) minus cash. This implies that negative values are companies with more cash than interest-bearing debt on their balance sheet. We apply the latest reported NIBD (for most companies) and market capitalizations from 31 December 2023 in our calculations of Enterprise Value multiples for 2023, and market capitalizations from 30 September 2024 for 2024E. MapsPeople’s net revenue retention rate (NRR) is based on MapsIndoors. All data is collected manually from reports, and we cannot guarantee the correctness of all data. Source: HC Andersen Capital and company reports.

Disclaimer: HC Andersen Capital receives payment from some of the mentioned SaaS companies (Agillic, Impero, MapsPeople, OrderYOYO, and Penneo) for a Digital IR/Corporate Visibility subscription agreement. All content in this newsletter is only for informational purposes. HC Andersen Capital cannot guarantee the correctness of all data in this newsletter.