The strong positive development for S&P Biotech or HCA Little Mermaid indexes in recent months and in particular through February of 2024, has probably puzzled some investors, as their personal average Biotech and Life Science portfolio return does not resemble the returns of the indexes. Of course, out- or underperformance versus the index is an inherent consequence for any investor actively picking individual stocks instead of buying the index.

But just as we have seen in the general stock market, where a disproportionately high part of the return in recent quarters or months has come from a few technology stocks – the Magnificent Seven or Fantastic Four, depending on the period in question – Biotech and Life Science index returns have also been heavily affected by a few stocks. To illustrate, it should come as no surprise that Biotech and Life Science companies engaged in the development of obesity-related products have attracted huge interest lately.

In the case of S&P Biotech, US-based Viking Therapeutics in late February announced strong Phase 2 data of its obesity product candidate, making its stock jump almost 150 percent in a few days, and as the stock had one of the highest weights in the index, Viking Therapeutics had a huge contributing effect of the S&P Biotech index return. The same was the case of the combined contribution from Danish-based obesity-focused Zealand Pharma and Gubra, which were both up 90-100 percent year-to-date, thereby strongly affecting the HCA Little Mermaid index, where they both have high weights. Consequently, if you have invested in these obesity-exposed companies, your Biotech and Life Science portfolio probably markedly outperformed the general stock market, whereas your portfolio returns without these few stocks would have had an average or underperforming return.

Going forward, obesity stocks will most likely continue to attract attention both in terms of the potential from further development of their pipelines, and, not least, as potential takeover targets from Big Pharma as they try to fill the gap from looming patent expiries. In the current environment, acquiring an obesity asset would probably be considered a low-risk investment for most Big Pharma companies due to the huge obesity market for the next many years to come. To some extent, the situation resembles that of the Covid-19 frenzy of pipeline projects and takeovers a few years ago, except that the obesity market potential will likely be higher for longer. This creates a longer-term potential for obesity-exposed Biotech and Life Science companies to be interesting from an investment perspective – both as stand-alone companies and take-over targets. Also, as mentioned in the February BioSnack edition, use of AI tools to enhance product development in the sector could be the next big thematic wave of Biotech and Life Science investing.

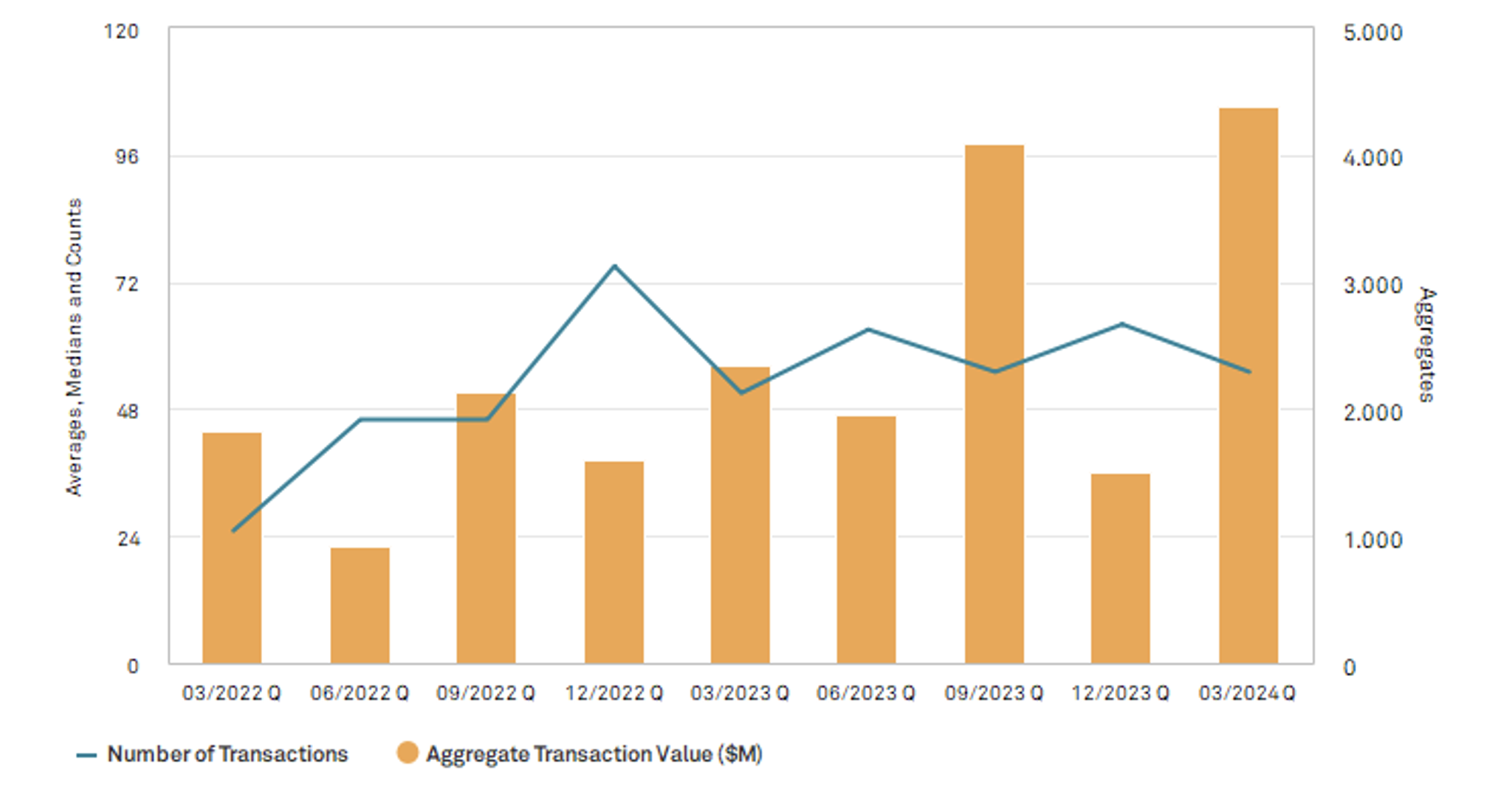

Just like those investors who have missed the obesity train, many management teams in Biotech and Life Science companies likely look with envy at the high average sector index return, realizing that the perceived better Biotech and Life Science sentiment is still not affecting their company’s share price or ability to raise capital. These companies are still not out of the woods. They could hope for the general takeover activity in the Biotech and Life Science sector to pick up further steam. So far it looks promising:

Transactions – Nordic Biotech & Life Science sector

Source: S&P CapitalIQ

As mentioned in the February BioSnack edition, the IPO window is also becoming more active (in the US), and, combined with the increasing takeover activity, conditions are improving for the Biotech and Life Science sector to attract further investor interest in a positive synergistic spin. Some companies gain, but not all. This dual market characteristic is very challenging for some companies as they are still unable to raise capital and have not felt any sentiment improvement. From an investment perspective, this can, however, be interpreted as constructive for Biotech and Life Science investing in general because it means fundamentals are increasingly becoming more relevant at the individual company level. Sceptics would argue we need a general market trigger to lift all stocks, but in the meantime, fundamental Biotech and Life Science investors would likely appreciate that returns increasingly come from Biotech and Life Science related factors – like obesity, AI, IPO, and takeover activity developing positively – irrespective of the impact from general market risk off and risk on triggers. That is also the sort of potential uncorrelated returns that add to the attractiveness of an investment portfolio as it lowers risk – all things being equal.

To summarize, Biotech and Life Science indexes are up strongly, but a lot of investors and companies still feel left behind. Before general market triggers lift all shares, investors – and companies – should take comfort in that individual Biotech and Life Science factors are developing positively, creating the foundation for longer lasting positive prospects for Biotech and Life Science investing.