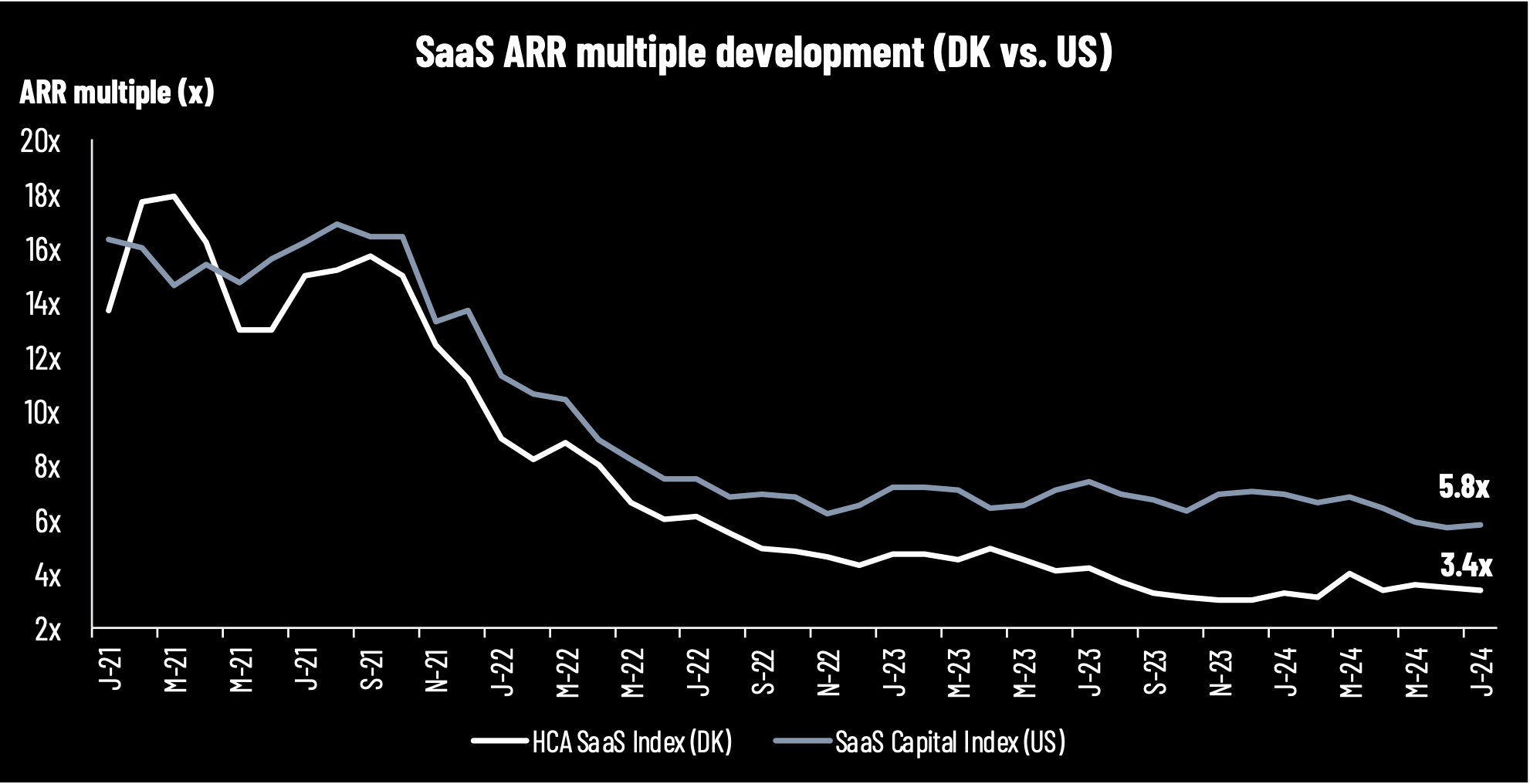

Source: HC Andersen Capital and The SaaS Capital Index

Lots of news from the Danish SaaS sector

First of all, RISMA and OrderYOYO came out with their Q2/H1 2024 trading statements. RISMA grew ARR by 33% YoY to DKK 39.1m and maintained 2024 ARR guidance of DKK 45-49m by the end of the year, corresponding to between 33-45% growth YoY. OrderYOYO continued its momentum, reaching ARR (annualized June MRR) of DKK 302m (23% growth YoY). OrderYOYO upgraded its guidance on net revenue, EBITDA before other extraordinary items, and Cash EBITDA. Net revenue guidance is now DKK 290-300m (before DKK 280-290m), EBITDA before other extraordinary items guidance is DKK 45-50m (before DKK 43-48m), and Cash EBITDA guidance is DKK 17-22m (DKK 15-20m).

At the beginning of July, Agillic announced that the company received a final decision from the Danish Tax Authorities regarding tax credit for 2019-2022. With an approval of 71% of the applied tax credit, this was an important announcement with a significant financial impact in 2024. In 2024, Agillic’s income statement will be positively impacted by a net profit increase of DKK 10.5m, the cash position will increase by DKK 2.1m, equity will increase by DKK 10.5m, and the short-term debt will be reduced by DKK 8.4m. This eliminates some risks, as the tax case could have impacted Agillic’s future growth investments.

Penneo also announced positive news in its expansion to Germany, as the company announced an agreement on Penneo KYC with Möhrle Happ Luther, a leading corporate law, audit, and tax firm in Germany.

MapsPeople has announced a rights issue of approx. DKK 36m, primarily for growth investments and to strengthen the capital structure. In a relatively tough capital market, MapsPeople has been able to secure gross proceeds of approx. DKK 34.8m through irrevocable subscription undertakings from existing shareholders and guarantee commitments from certain new investors. The subscription price is DKK 2.00 per 1 new share. Besides growth capital for its operational plan and maintaining high growth rates through investments in sales and marketing efforts, the company has also been presented with multiple smaller M&A opportunities that could accelerate the ARR and revenue growth as well as have a positive EBITDA and cash generation impact from cost synergies post-integrations within 6-12 months. MapsPeople expects that DKK 20-25m of the gross proceeds from the capital raise will be used for M&A. We are hosting an event with the management on 15 August at 13:00, which you can sign up to here.

Looking into August 2024, most of the Danish SaaS companies will report their financial results for Q2 2024, which will provide us with a clearer picture of how the different SaaS companies and their end markets are developing.

Global macro and AI dominate the direction

Where are we going on a macro level? Our August update will put more flavor on the macro uncertainty with recession fears, yet this has sent the US 10Y bond yield down below 4%, which is positive for the SaaS sector.

Besides general economic uncertainty, SaaS companies are still facing challenges with a more mature SaaS industry. Budgets are being reallocated to different AI solutions, and SaaS companies with AI elements must convince potential buyers that their solutions are future-proof.

On a global SaaS sector level, our impression is that new sales in Q2 have been challenged. This is supported by data from Clouded Judgement (Jamin Ball) from 2 August 2024. The Q2 earnings season began for some of the global/US SaaS companies. In line with the weak guidance from Q1, the Q2 results were quite bad based on net new ARR in the quarter. According to Clouded Judgement (Jamin Ball) which measures a basket of global SaaS companies that have reported earnings (2 August 2024 – early into the Q2 earnings), the net new ARR decreased significantly to USD 615m in Q2 2024 in the quarter (vs. USD 860m in Q2 2023, and USD 969m in Q2 2022). Looking into Q3 guidance, most of these companies also guided below consensus.

Moreover, In July, we saw an example of how a faulty update from a Crowdstrike, in this case, a global cybersecurity firm, can affect Microsoft’s Windows system and ultimately lead to a very costly error for many companies across industries.

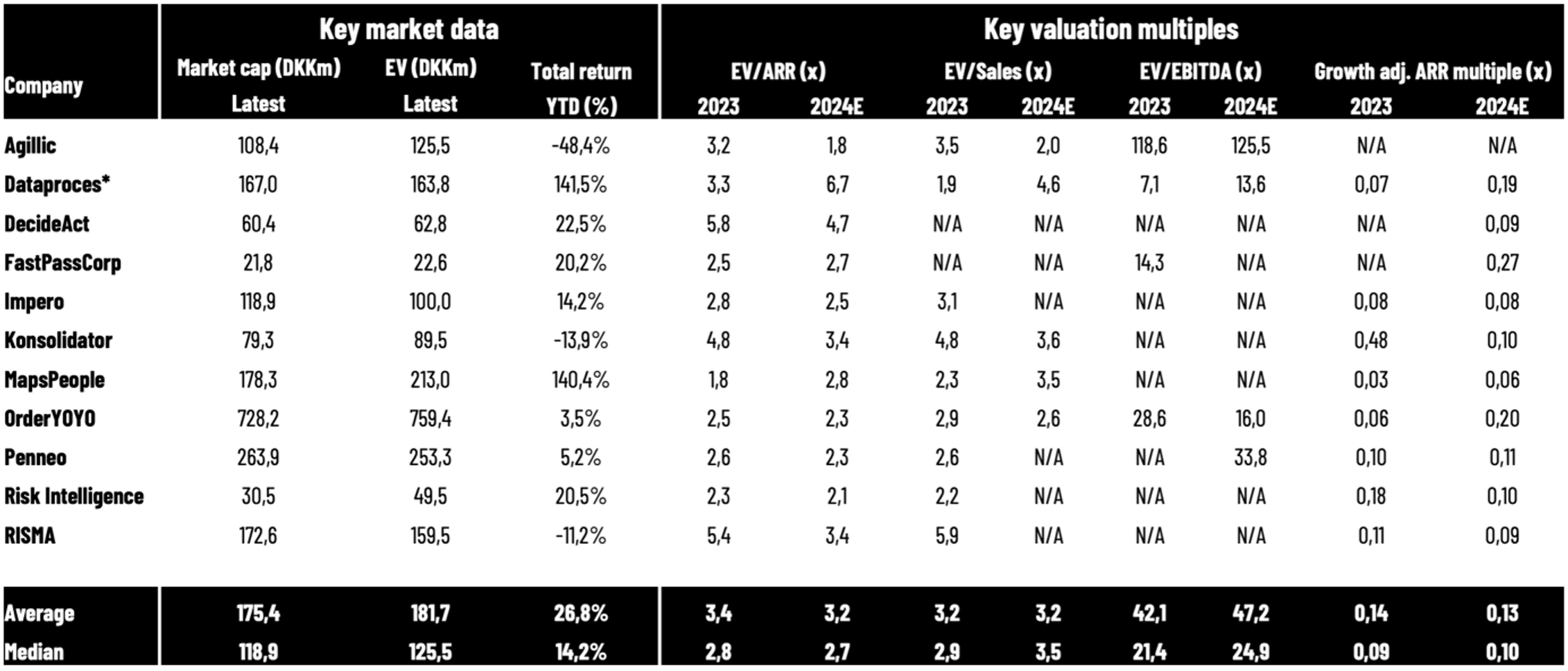

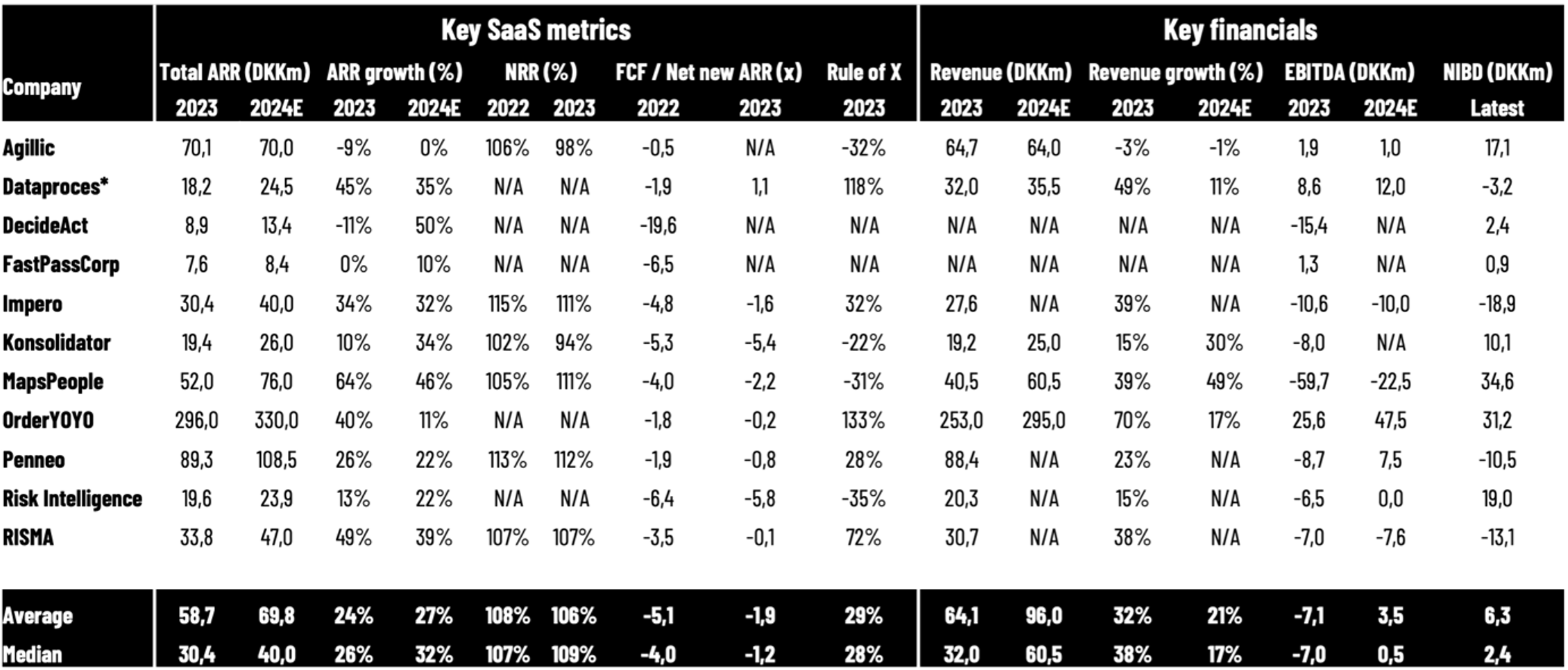

Overview of key metrics for Danish SaaS companies

We have collected data from 11 listed Danish SaaS companies. The overview will be updated on an ongoing basis. Market capitalizations are latest updated on 31 July 2024. Read the note below the tables for more detailed information.

Note: The table above summarizes key market data, key valuation multiples, key SaaS metrics, and key financials for Danish-listed SaaS companies reporting ARR (some software companies such as cBrain do not include ARR in their reporting and are not included). *Dataproces has a skewed/different accounting period than a regular calendar year. We apply the companies’ reported SaaS metrics, however, there are differences in the reporting methodologies, as there are no regulations or standards yet. When applying 2024E for the companies, we are using the companies’ guidance ranges (midpoint). We apply OrderYOYO’s pro forma net revenue in this overview (app smart consolidated full year) for both valuation multiples and growth rates. FCF/Net new ARR (2022) is calculated by taking FCF (cash flow from operations minus CAPEX, primarily investments in intangible assets) and the net ARR increase by the end of 2022 compared to the end of 2021. Penneo adjusts its FCF/Net new ARR ratio by DKK 2.4m due to costs related to the listing on the Main Market. Taking these costs out, the ratio will decline from -1.9x to -1.7x. In the calculation of net-interest-bearing debt (NIBD) for the companies in 2022, we have applied interest-bearing debt (including leasing liabilities) minus cash. This implies that negative values are companies with more cash than interest-bearing debt on their balance sheet. We apply the latest reported NIBD (for most companies) and market capitalizations from 31 December 2023 in our calculations of Enterprise Value multiples for 2023, and market capitalizations from 31 July 2024 for 2024E. MapsPeople’s net revenue retention rate (NRR) is based on MapsIndoors. All data is collected manually from reports, and we cannot guarantee the correctness of all data. Source: HC Andersen Capital and company reports.

Disclaimer: HC Andersen Capital receives payment from some of the mentioned SaaS companies (Agillic, Impero, MapsPeople, OrderYOYO, and Penneo) for a Digital IR/Corporate Visibility subscription agreement. All content in this newsletter is only for informational purposes. HC Andersen Capital cannot guarantee the correctness of all data in this newsletter.