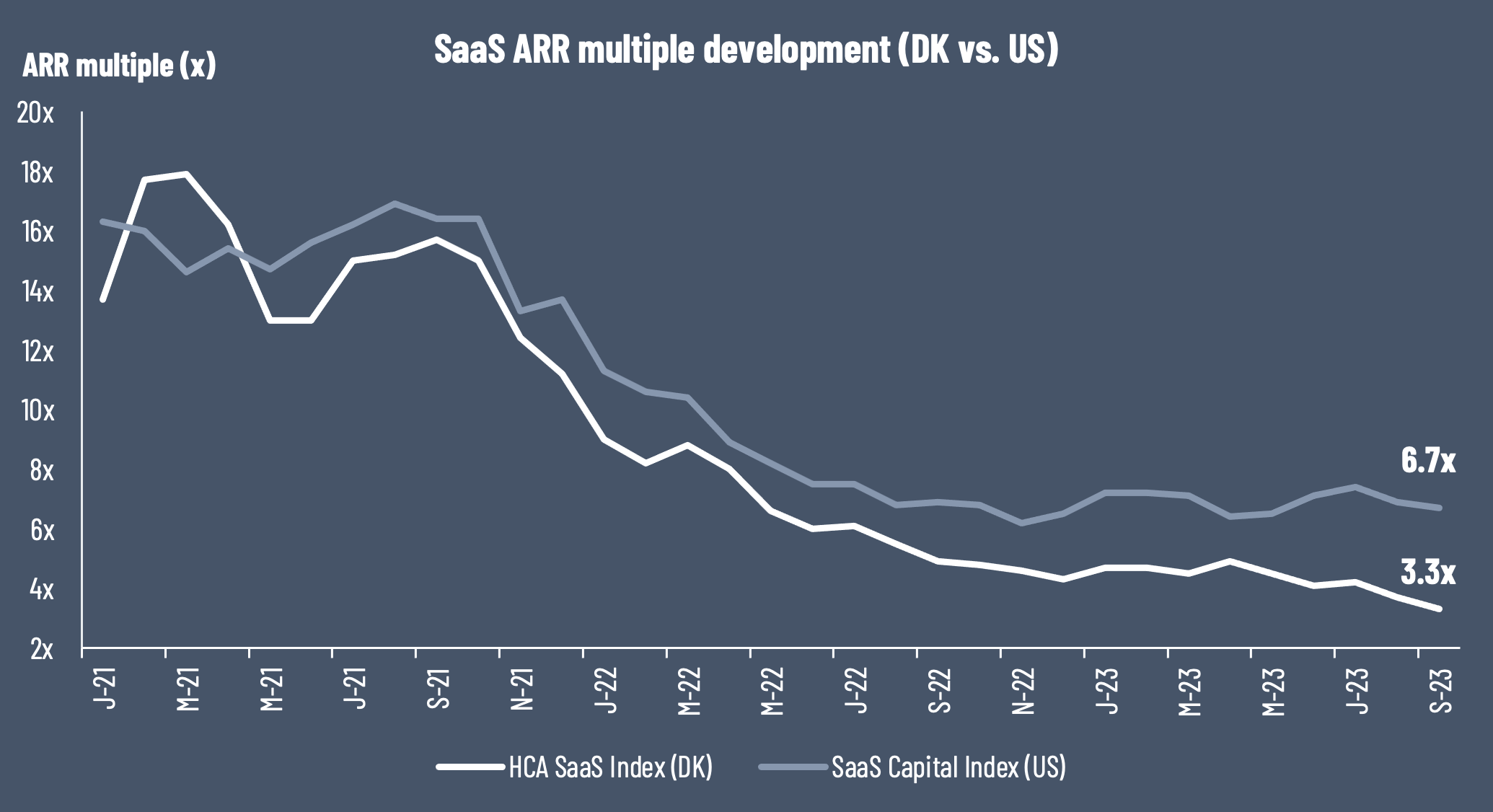

Interest rates keep rising – we now observe a larger US vs. DK SaaS valuation gap

Stronger than expected US macroeconomic data with strong labor markets and a resilient economy has led to a rising US 10Y bond yield, now at a record-high level not seen since 2007 of close to, yet still below 5%. The FED has indicated a “higher for longer” interest rates regime, hitting the stock market returns negatively recently.

However, the median ARR multiple in the US SaaS sector has been somewhat stable in recent months, while the Danish SaaS sector has declined to a new lowest level. With slightly lower share prices (median) across the Danish SaaS companies combined with a delisting of Digizuite (traded at 6.7x ARR in the last update in August) at the beginning of September, the median ARR multiple is now at 3.3x ARR across the Danish listed SaaS companies. Compared to the US SaaS sector, we currently see a large valuation gap, as the median multiple is 6.7x ARR across the US-listed SaaS companies.

Source: HC Andersen Capital and The SaaS Capital Index

As highlighted in earlier newsletters, we acknowledge that large global US SaaS companies should be valued at higher valuations than the smaller Danish-listed SaaS companies due to higher share liquidity, less dependence on new capital, and less risk in general. Moreover, a larger part of US-listed SaaS companies has been positively affected by the recent AI boom. Nevertheless, it is worth noticing that the valuation gap seems to be at a high level now, as the US SaaS sector (median) trades at a level that is more than 100% above the Danish SaaS sector (median). The growth potential may be bigger for the smaller and more early-stage Danish-listed SaaS companies, however, they may also be more sensitive to accelerating interest rates.

Mixed start of the first US SaaS IPO – Klaviyo

As mentioned in last month’s SaaS newsletter, the first US SaaS IPO in approx. two years – Klaviyo – was on its way. At that time, the expected/rumored IPO price was USD 26.00 per share. Due to high investor interest, however, the initial public offering price increased to USD 30.00 per share, and the first day of trading was on Wednesday, 20 September 2023. Following a strong start, it jumped nearly 23% on the first day of trading and the share closed at USD 37.00 on 28 September. However, Klaviyo declined to approx. USD 34.00 at the end of September 2023 and is now trading at USD 32.62, which is still above the IPO price of USD 30.00 per share.

The question is whether the IPO could support a new SaaS IPO wave. It is positive that the price continues to be above the IPO price, yet it cannot be seen as a “big success” yet, also being negatively affected by the recent decline in the stock markets. That said, the valuation multiple is also close to larger global quality US-listed SaaS companies. With the raised IPO price and a share price above USD 30.00, Klaviyo now trades in line with larger SaaS companies such as HubSpot and Adobe of approx. 12-13x EV/Sales LTM (source: Refinitiv). Whether a premium is justified may be assessed in the upcoming financial reports. Nevertheless, Klaviyo has done well recently by increasing implied ARR and revenue by more than 50% LTM and has also been operationally profitable in the past two quarters.