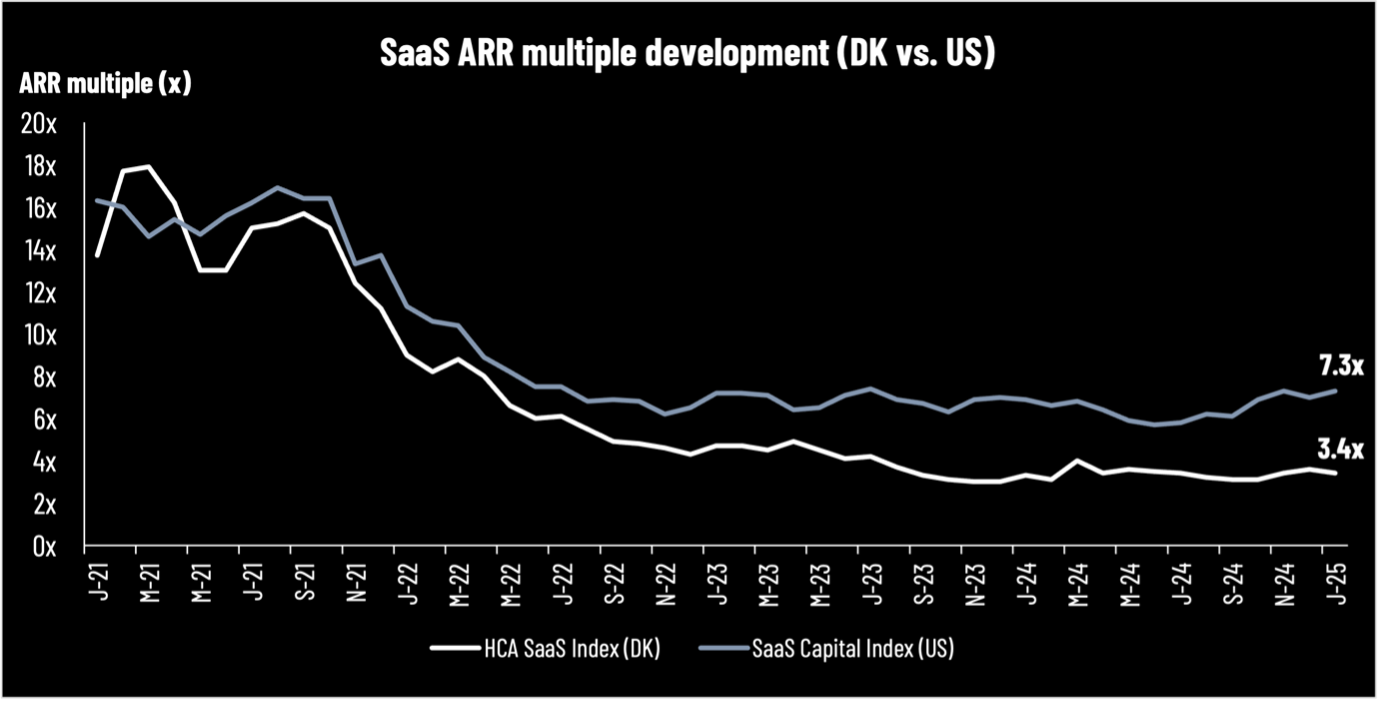

US SaaS sector still trades close to double up vs. the Danish SaaS sector on the ARR multiple

By the end of January 2025, our HCA SaaS Index ended at a median multiple of 3.4x (3.6x by the end of December 2024), while The SaaS Capital Index covering the US/global SaaS market ended January 2025 with a median ARR multiple of 7.3x (from 7.0x by the end of December 2024). The widening gap between the US and Danish SaaS companies could be explained by the fact that it seems to be the AI story and move away from infrastructure to applications on the DeepSeek news flow that is driving the US SaaS companies, more than a better short-term growth outlook. This means that a small number of companies is getting a very high valuation and thus lift the multiple. Secondly, there are only very few clear short-term AI stories among the Danish-listed SaaS companies.

Cloud giants' growth plateauing

Compared to the growth rates in Q3 2024, both Google Cloud and Azure (Microsoft) did see declining growth momentum in Q4 2024, while AWS (Amazon) was flat. Furthermore, they all gave pretty muted next quarter guidance for their cloud divisions. This normally does not bode well for the coming SaaS reporting season. However, it seems that some of the weaker growth and disappointing outlooks are due to capacity constraints, implying that the read-over to the SaaS sector may be a less strong signal.

In connection with the latest financial reports from the cloud divisions of Amazon, Microsoft, and Google, we can look at the year-over-year (YoY) growth and the growth in the most recent quarter based on the new rates.

- Amazon’s cloud business (AWS): YoY growth was 19%, with 19% growth in the latest quarter.

- Google’s cloud business (Google Cloud, which includes GSuite): YoY growth was 30%, with a 35% increase in the latest quarter.

- Microsoft’s cloud business (Azure): YoY growth was 31%, with a 34% increase in the latest quarter.

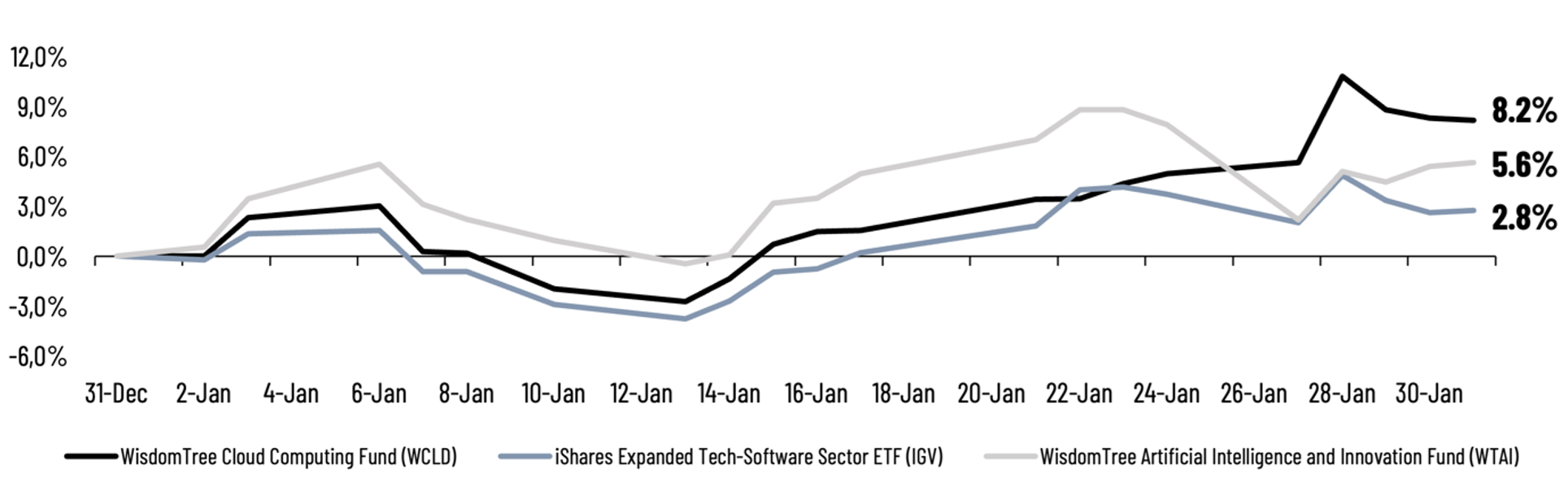

DeepSeek – we already see signs of investors moving to the application part of the AI story

While there is still debate whether DeepSeek is a copy of OpenAI (or data might be false), we already see signs of investors moving from the first stage of a new technology boom, namely infrastructure, to the application/user part. Looking at year-to-date returns, the Cloud Computing ETF, which contains a larger part of the smaller and less profitable SaaS companies, has outperformed pure play AI ETF. It has even outperformed the expanded tech software ETF, which contains larger and more quality companies – an indication that we could see a higher tolerance for risk when looking at software companies.

This is a normal step in a new technological transformation. Besides DeepSeek, we have also heard from IBM and ServiceNow that the cost is coming down heavily, and they see this trend is driving a hefty increase in AI adoption. This should also support increasing investor interest in the software/SaaS part of the value chain.

Denmark – first indications for year-end 2024 and 2025 expectations

In January and early February 2025, the first companies provided an update for 2024/guidance adjustments for their 2024 results, as well as expectations for 2025.

Impero announced an improved EBITDA outlook for 2024, now expecting EBITDA in the range of DKK -9m to -8.5m (before DKK -11m to -9m) due to other capacity costs and staff costs reaching a lower level than anticipated. Moreover, Impero also announced a preliminary ARR result, amounting to DKK 38.7m (27% growth YoY) by the end of 2024. This is within Impero’s guidance range of DKK 38-42m.

OrderYOYO reached results above its recent guidance upgraded range in 2024 and also raised its 2025 guidance. After a strong end of 2024, OrderYOYO now expects ARR (annualized December MRR) of DKK 410-420m by the end of December 2025 (approx. 15% growth YoY), net revenue in 2025 in the range of DKK 380-390m (approx. 23% growth YoY), EBITDA before other extraordinary items in 2025 of DKK 70-75m (approx. 30% growth YoY), Cash EBITDA before other extraordinary items in 2025 of DKK 43-48m (approx. 63% growth YoY), and GMV (annualized December GMV) of DKK 4,000-4,200m by the end of December 2025 (approx. 8% growth YoY).

MapsPeople adjusted its ARR guidance downwards for 2024, as the company’s ARR is expected to be DKK 58.2m by the end of 2024 (the previous guidance range was DKK 59-63m), corresponding to 12% growth YoY. The downgrade is explained by the timing of the start date of a new contract. The 2024 revenue and EBITDA bsi guidance ranges are maintained. MapsPeople also provided 2025 guidance, expecting ARR in the range of DKK 70-80m (20-37% growth YoY) by the end of 2025. In 2025, revenue is expected in the range of DKK 66-75m, and EBITDA is expected to be between DKK -20m to -10m.

Agillic announced the preliminary results for 2024. Both on revenue and ARR the result came below expectations. ARR from subscriptions is expected to be DKK 54.3m, and therefore under the guidance range of DKK 56-60m. ARR from transactions is expected to be DKK 11.2m, which aligns with the guided range of DKK 10-14m. Revenue is expected to be DKK 60.2m, a decline of around 7% compared to 2023 and below the guided range of DKK 62–66m. Despite the shortfall in revenue, the company is delivering on its targets of positive EBITDA. The EBITDA of DKK 1m is in line with the guided range of DKK 0-2m. Agillic also provides guidance for 2025 where Agillic expects revenue in the range of DKK 60-63m, and an EBITDA of DKK 5-8m. ARR from subscriptions is expected to grow to DKK 56-60m.

Additionally, VISMA’s offer for Penneo has been accepted by more than 90% of the shareholders. This implies that the Penneo share will soon be delisted.

Upcoming Danish annual 2024 SaaS reports

The Danish SaaS companies will report their financial results for 2024 in the coming period. Konsolidator and Agillic will be the next to publish their reports on 6 February and 24 February, respectively.

Some of the Danish SaaS companies have already announced preliminary figures for 2024. Once the financial reports are released, we will update our overview of key SaaS metrics for the Danish SaaS companies with the final figures for 2024 and guidance for 2025E.

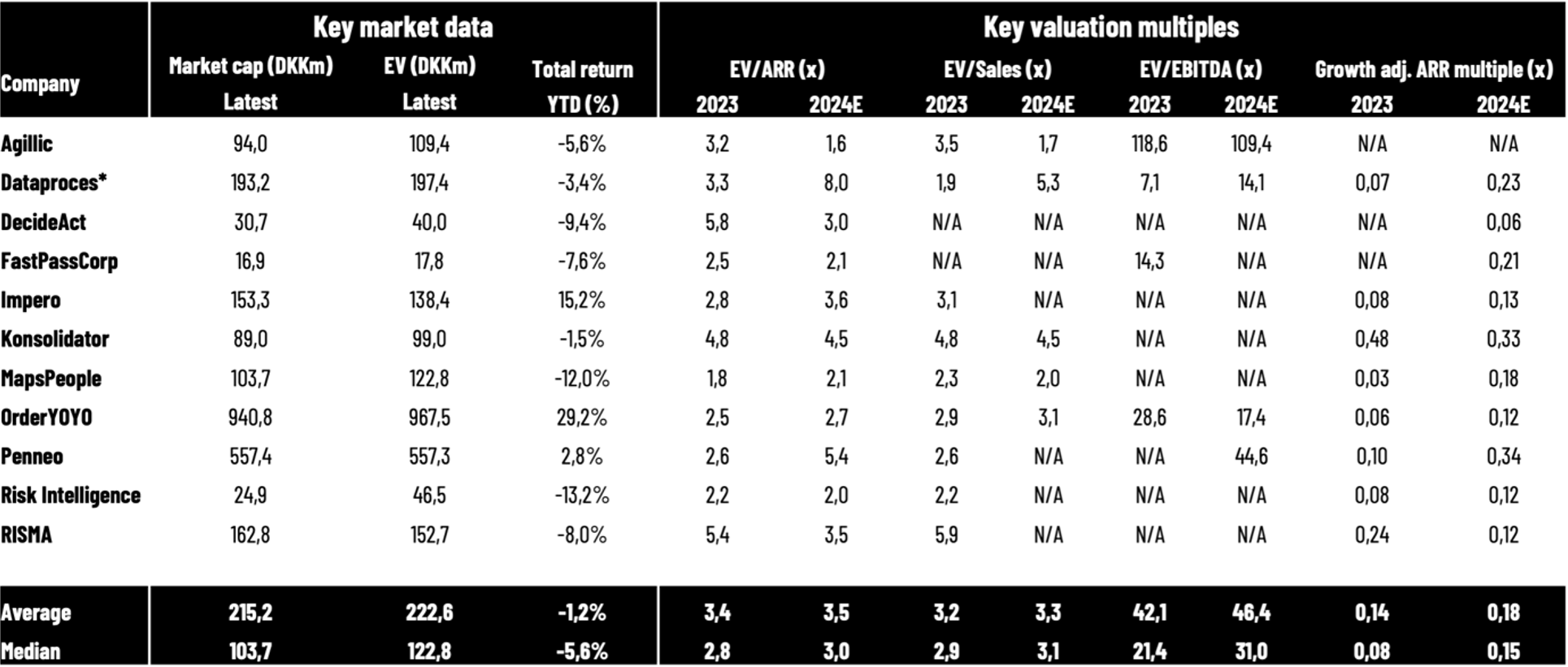

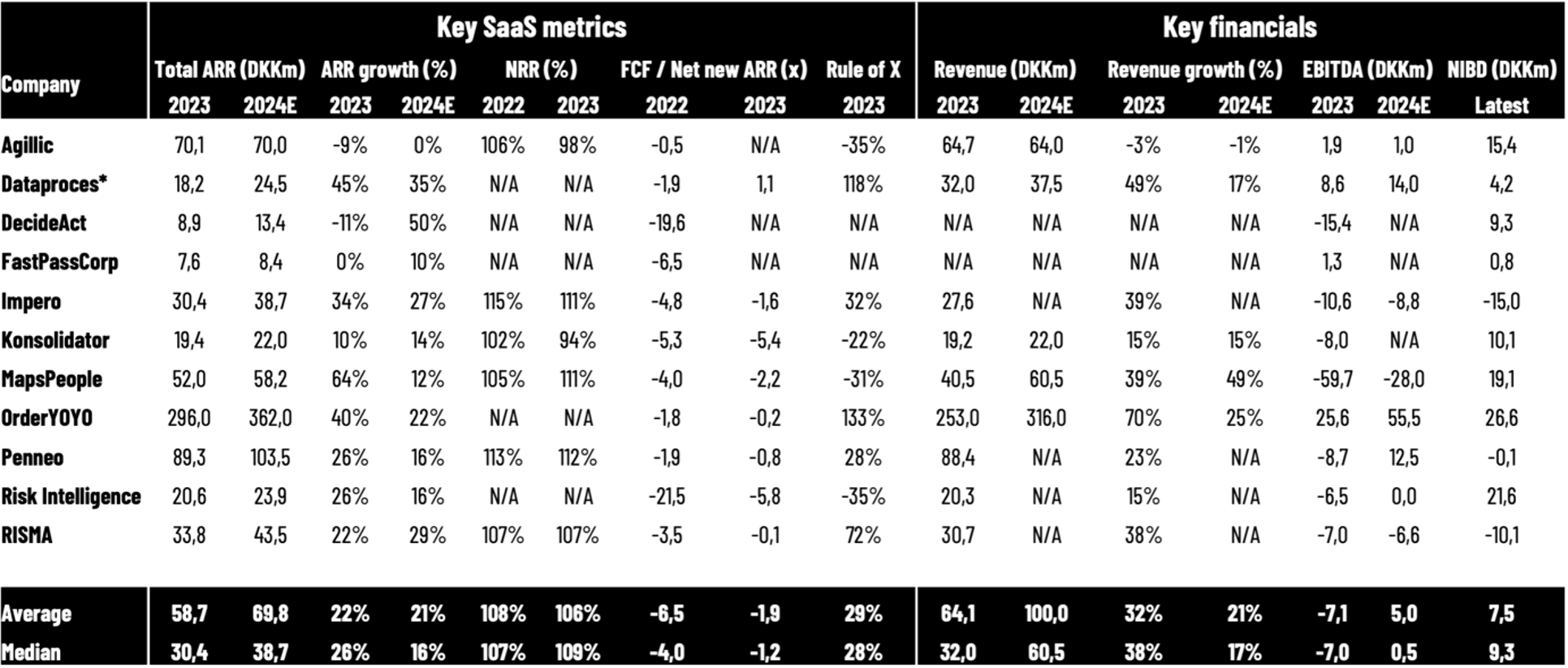

Overview of key metrics for Danish SaaS companies

We have collected data from 11 listed Danish SaaS companies. The overview will be updated on an ongoing basis. Market capitalizations are latest updated on 31 January 2025. Read the note below the tables for more detailed information.

Note: The table above summarizes key market data, key valuation multiples, key SaaS metrics, and key financials for Danish-listed SaaS companies reporting ARR (some software companies such as cBrain do not include ARR in their reporting and are not included). *Dataproces has a skewed/different accounting period than a regular calendar year. We apply the companies’ reported SaaS metrics, however, there are differences in the reporting methodologies, as there are no regulations or standards yet. When applying 2024E for the companies, we are using the companies’ guidance ranges (midpoint). We apply OrderYOYO’s pro forma net revenue in this overview (app smart consolidated full year) for both valuation multiples and growth rates. FCF/Net new ARR (2022) is calculated by taking FCF (cash flow from operations minus CAPEX, primarily investments in intangible assets) and the net ARR increase by the end of 2022 compared to the end of 2021. Penneo adjusts its FCF/Net new ARR ratio by DKK 2.4m due to costs related to the listing on the Main Market. Taking these costs out, the ratio will decline from -1.9x to -1.7x. In the calculation of net-interest-bearing debt (NIBD) for the companies in 2022, we have applied interest-bearing debt (including leasing liabilities) minus cash. This implies that negative values are companies with more cash than interest-bearing debt on their balance sheet. We apply the latest reported NIBD (for most companies) and market capitalizations from 31 December 2023 in our calculations of Enterprise Value multiples for 2023, and market capitalizations from 31 January 2025 for 2024E. MapsPeople’s net revenue retention rate (NRR) is based on MapsIndoors. All data is collected manually from reports, and we cannot guarantee the correctness of all data. Source: HC Andersen Capital and company reports.

Disclaimer: HC Andersen Capital receives payment from some of the mentioned SaaS companies (Agillic, Impero, MapsPeople, OrderYOYO, and Penneo) for a Digital IR/Corporate Visibility subscription agreement. All content in this newsletter is only for informational purposes. HC Andersen Capital cannot guarantee the correctness of all data in this newsletter.