First announcements of Q3 2024 reports and other news from the Danish SaaS sector

Agillic maintained its expectations due to expected growth from both existing clients and new sales in Q4 2024. After challenges from clients churning due to technology consolidations at the beginning of the year, the company’s ARR declined -8% YoY by the end of Q3 2024. However, Agillic improved its results slightly QoQ in Q3 2024, and EBITDA remained positive at DKK 1.2m in Q3 2024 (DKK 1.8m in Q3 2024 YTD).

Watch Agillic’s Q3 2024 presentation here.

In late October, Agillic also announced a new CEO, Christian Samsø, who will take over the position from Emre Gürsoy.

The largest SaaS company in the Danish SaaS sector, OrderYOYO, grew its ARR to DKK 304m (19% YoY) in September with a continued positive development in its EBITDA.

Moreover, the company became even bigger with the acquisition of the UK and Ireland-based online and kiosk ordering company, App4, in an all-cash transaction of DKK 54m. The new acquisition is in line with OrderYOYO’s European consolidation strategy.

The 2024 guidance was raised, implying that ARR (December 2024 annualized) is expected to be DKK 340-350m (before DKK 325-335m), net revenue of DKK 300-305m (before DKK 290-300m), EBITDA before other extraordinary items of DKK 47-52m (before DKK 45-50m), Cash EBITDA before other extraordinary items of DKK 20-25m (before DKK 17-22m), and GMV (December annualized) of DKK 3,550-3,650m (before DKK 3,300-3,400m).

Watch the Q3 2024 trading update with insights into the acquisition with OrderYOYO’s management here.

Other news from the Danish SaaS sector includes an acquisition from MapsPeople. MapsPeople announced the acquisition of Point Consulting’s indoor mapping activities (customer contracts and associated technology), which is in line with the company’s M&A strategy following the successful capital raise a few months ago. Point Consulting is Singapore-based and the 17 acquired customers are mainly within airports, adding a minimum of DKK 2.1m in ARR. The activities are acquired for DKK 5.3m (approx. 2.5x ARR) and a maximum of DKK 8.1m (approx. 3.8x ARR) from a cash-earn-out and a share-based earn-out.

Watch our interview about the acquisition with MapsPeople’s CEO here.

Dataproces did also upgrade its 2024/25 guidance in October. However, the upgrade is on revenue and profitability (EBITDA and EBIT), driven by its Data Analysis segment. As a result, the company’s software sales (ARR) are maintained at a growth rate level of 30-40% YoY, as the software sales are performing according to Dataproces’ initial expectations.

Looking ahead into November, we will get more insights into the Q3 results and outlook for the rest of the Danish SaaS sector. We are hosting several events with management. Sign up and check the upcoming events here.

Looking ahead into November, we will get more insights into the Q3 results and outlook for the rest of the Danish SaaS sector. We are hosting several events with management. Sign up and check the upcoming events here.

News from the hyperscalers

Globally, the hyperscalers (Amazon AWS, Google Cloud, and Microsoft Azure) always start the Q3 earnings season, by providing insights into how cloud consumption develops, i.e. giving us some perspectives on investments. In Q3, we saw some acceleration as Google Cloud grew to 35% YoY (from 29% in the prior quarter), Microsoft Azure and other cloud services grew 33% YoY (from 29% in the prior quarter), and Amazon grew its AWS business by 19% YoY in the quarter (19% YoY in the prior quarter). Thus, it provides a somewhat positive outlook for the IT- and SaaS sector with this acceleration for Microsoft and Google, yet the growth is also fueled by increased AI demand.

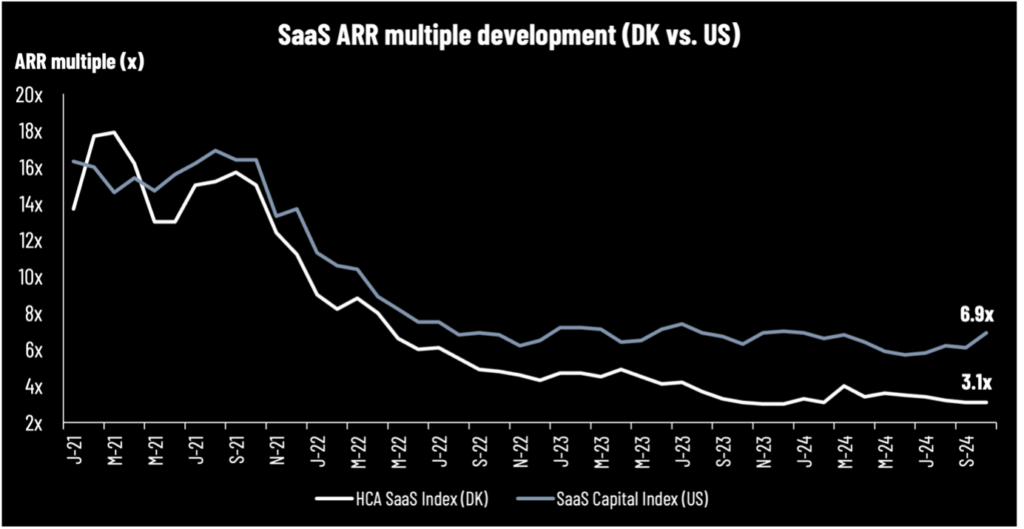

US 10Y bond yield up – but an economic boost under Trump in the US?

In line with comments from the latest newsletter, we are seeing that SaaS valuations (growth segment) are somewhat negatively correlated with the US 10Y bond yield. Thus, the increasing US 10Y bond yield in October may have some negative effects on the market sentiment and risk appetite in the SaaS sector when looking ahead. The bond yield accelerated further above 4.00% at the beginning of November after the election of Trump as the next President of the US. On the other hand, we have seen a positive stock market reaction in the US after the presidential election driven by the expectations of lower corporate taxes and deregulation under Trump.

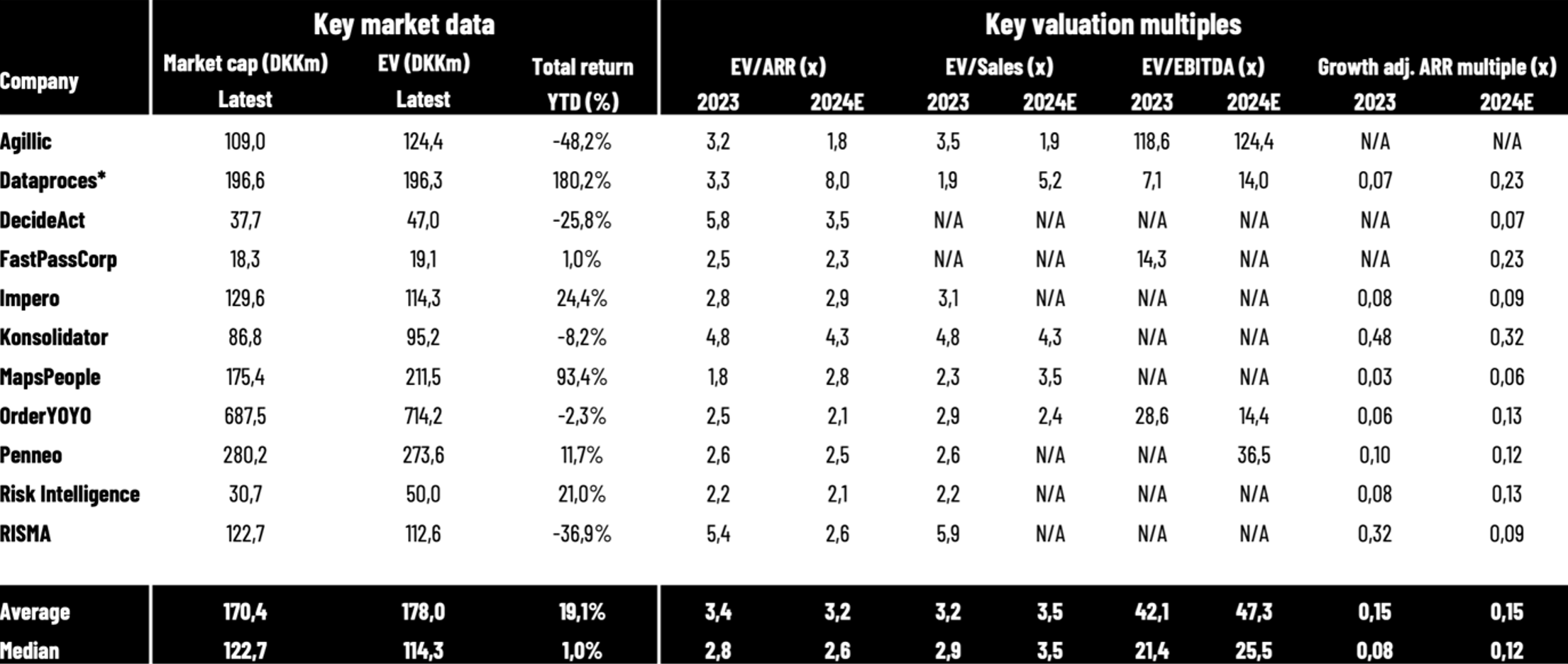

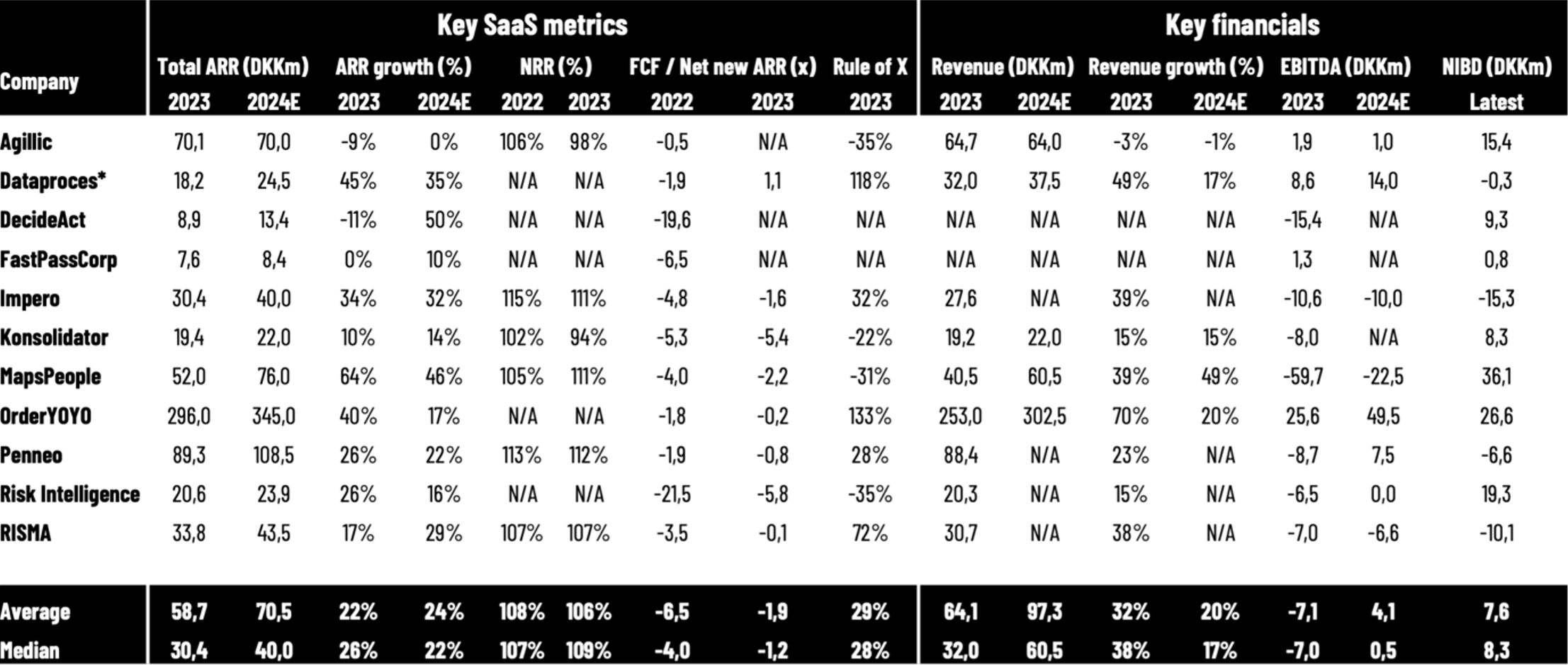

Overview of key metrics for Danish SaaS companies

We have collected data from 11 listed Danish SaaS companies. The overview will be updated on an ongoing basis. Market capitalizations are latest updated on 31 October 2024. Read the note below the tables for more detailed information.

Note: The table above summarizes key market data, key valuation multiples, key SaaS metrics, and key financials for Danish-listed SaaS companies reporting ARR (some software companies such as cBrain do not include ARR in their reporting and are not included). *Dataproces has a skewed/different accounting period than a regular calendar year. We apply the companies’ reported SaaS metrics, however, there are differences in the reporting methodologies, as there are no regulations or standards yet. When applying 2024E for the companies, we are using the companies’ guidance ranges (midpoint). We apply OrderYOYO’s pro forma net revenue in this overview (app smart consolidated full year) for both valuation multiples and growth rates. FCF/Net new ARR (2022) is calculated by taking FCF (cash flow from operations minus CAPEX, primarily investments in intangible assets) and the net ARR increase by the end of 2022 compared to the end of 2021. Penneo adjusts its FCF/Net new ARR ratio by DKK 2.4m due to costs related to the listing on the Main Market. Taking these costs out, the ratio will decline from -1.9x to -1.7x. In the calculation of net-interest-bearing debt (NIBD) for the companies in 2022, we have applied interest-bearing debt (including leasing liabilities) minus cash. This implies that negative values are companies with more cash than interest-bearing debt on their balance sheet. We apply the latest reported NIBD (for most companies) and market capitalizations from 31 December 2023 in our calculations of Enterprise Value multiples for 2023, and market capitalizations from 31 October 2024 for 2024E. MapsPeople’s net revenue retention rate (NRR) is based on MapsIndoors. All data is collected manually from reports, and we cannot guarantee the correctness of all data. Source: HC Andersen Capital and company reports.

Disclaimer: HC Andersen Capital receives payment from some of the mentioned SaaS companies (Agillic, Impero, MapsPeople, OrderYOYO, and Penneo) for a Digital IR/Corporate Visibility subscription agreement. All content in this newsletter is only for informational purposes. HC Andersen Capital cannot guarantee the correctness of all data in this newsletter.