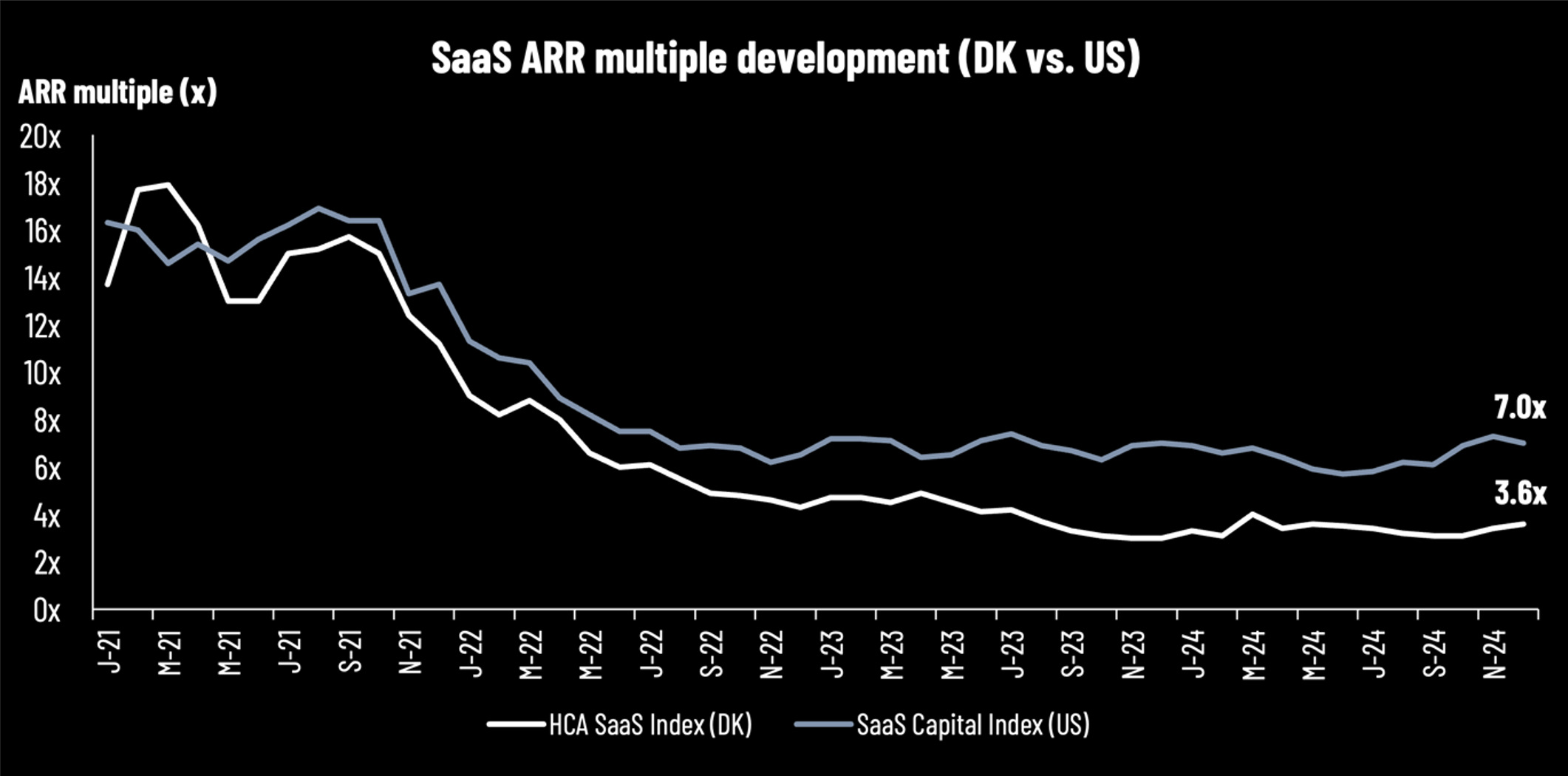

US SaaS sector still trades close to double up vs. Danish SaaS sector on the ARR multiple

As 2024 is now behind us, it is time to conclude the year and look into 2025. Our HCA SaaS Index ended December 2024 with a median ARR multiple of 3.6x (3.4x by the end of November 2024), while The SaaS Capital Index covering the US/global SaaS market ended December 2024 with a median ARR multiple of 7.0x (from 7.3x by the end of November 2024). This implies that the US SaaS sector trades at a multiple which is nearly double up vs. the median ARR multiple on the Danish SaaS sector.

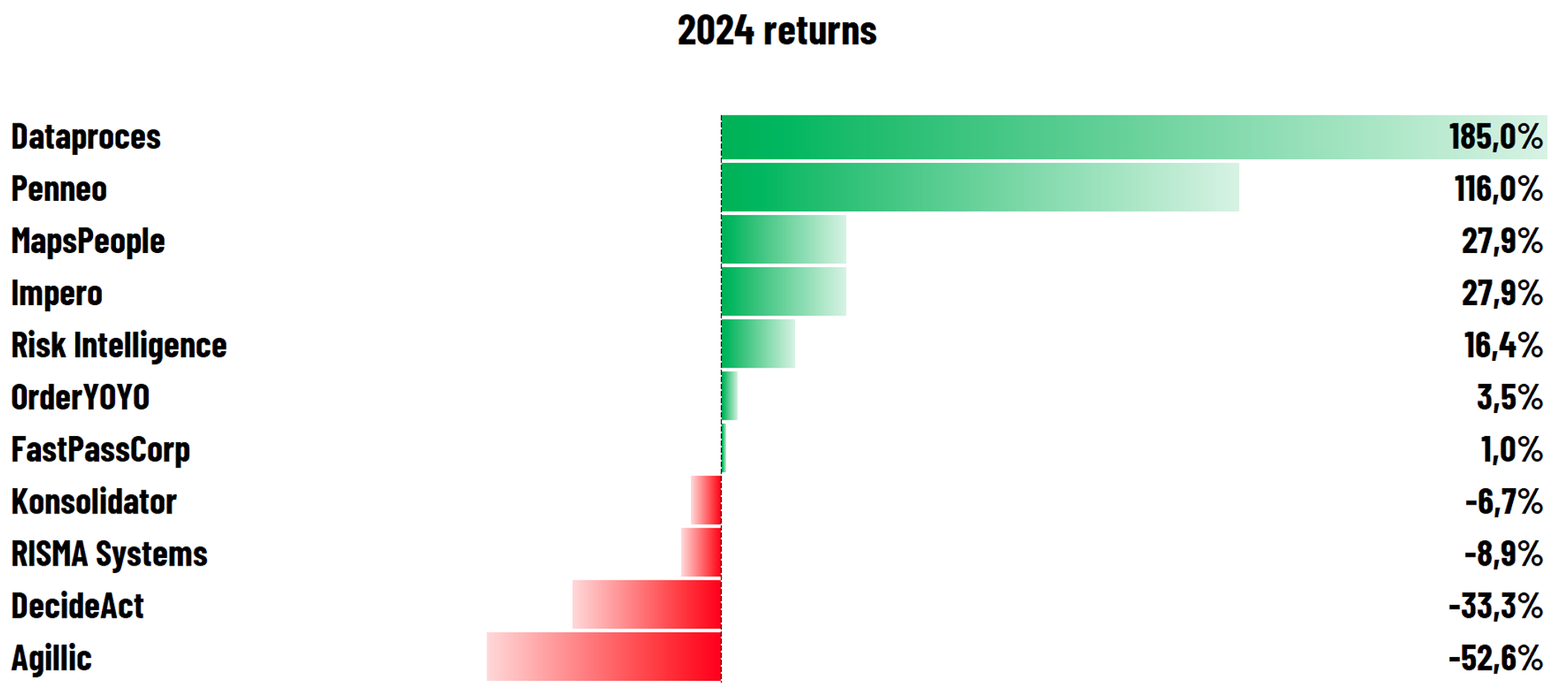

2024 returns in the Danish SaaS sector

Looking at share price returns across the Danish SaaS sector, the developments have been mixed. Excluding the delistings in 2024, the current 11 listed companies in the Danish SaaS sector provided a median and average return of approx. 3.5% and approx. 25% in 2024, respectively.

The high double-digit average return was primarily driven by Dataproces’ substantial share price increase of 185%, driven by guidance upgrades after a successful turnaround with an increased focus on profitable growth. Additionally, Visma’s takeover offer on Penneo implied that the Penneo share gained 116% in 2024. Other high double-digit returns came from MapsPeople (approx. 28%) and Impero (approx. 28%) in 2024. Get the full overview here:

New successful SaaS IPO in the US

In December 2024, the US SaaS sector welcomed a new IPO, as ServiceTitan started trading after a successful IPO. Each ServiceTitan share was offered at USD 71.00 per share, and the ServiceTitan share now trades above approx. USD 100, corresponding to more than approx. 40% above the offer price. Since the golden era in 2020-2021, only three SaaS companies – Klaviyo, Rubrik, and OneStream – have made an IPO before this from ServiceTitan. ServiceTitan provides a SaaS platform that transforms the home and commercial services industry. It empowers trade businesses with tools for CRM, scheduling, and financial management, which increase efficiency and scalability in traditionally underserved markets.

Some optimism into 2025

With the successful US SaaS IPO and better investor sentiment, this could bring some tailwinds into 2025. Among the Danish-listed SaaS companies, however, other factors are crucial, including access to new capital for the smallest ones. Unfortunately for the Danish stock market, we are still seeing that some SaaS companies are being acquired off the market as mentioned in the recent newsletter, most recently with Penneo, at EV/ARR multiples significantly above the current valuation level across the listed SaaS companies in the Nordics. As highlighted before, valuations are also affected by interest rates. In the US, the 10Y bond yield has accelerated, which could damper the risk appetite if this continues in 2025. Yet, there are still expectations of lower interest rates, but the road is – nearly always – bumpier than initially expected.

Growth benchmark

Looking more overall, most SaaS companies have pivoted their strategy towards profitable growth over the past years. This aligns with the current market environment, as the growth rates across the SaaS sector have somewhat normalized after the golden era. Profitability and free cash flow may still be important in 2025, yet growth rates are still an important determinator for valuations given the nature of the SaaS model and the value of recurring revenue.

Across the Danish SaaS sector, the expected growth rate level is 17% (median) and 21% (average) based on the Danish-listed SaaS companies’ own 2024 ARR guidance ranges (midpoint). Looking across the larger US SaaS sector (data from Jamin Ball, Clouded Judgement), the revenue growth level (last 12 months) is 14% (median) and 16% (average).

Looking into 2025 and the next 12 months, the average and median revenue growth rates in the US SaaS sector are estimated to be 12% (Jamin Ball, Clouded Judgement). Steep, accelerating growth rates above 30-35% are rare among more mature US SaaS companies. However, such growth may still be observed in smaller SaaS companies with significant expansion opportunities or companies with new emerging technologies offering a ‘need-to-have’ value proposition within specific domains.

Looking more overall, most SaaS companies have pivoted their strategy towards profitable growth over the past years. This aligns with the current market environment, as the growth rates across the SaaS sector have somewhat normalized after the golden era. Profitability and free cash flow may still be important in 2025, yet growth rates are still an important determinator for valuations given the nature of the SaaS model and the value of recurring revenue.

Across the Danish SaaS sector, the expected growth rate level is 17% (median) and 21% (average) based on the Danish-listed SaaS companies’ own 2024 ARR guidance ranges (midpoint). Looking across the larger US SaaS sector (data from Jamin Ball, Clouded Judgement), the revenue growth level (last 12 months) is 14% (median) and 16% (average).

Looking into 2025 and the next 12 months, the average and median revenue growth rates in the US SaaS sector are estimated to be 12% (Jamin Ball, Clouded Judgement). Steep, accelerating growth rates above 30-35% are rare among more mature US SaaS companies. However, such growth may still be observed in smaller SaaS companies with significant expansion opportunities or companies with new emerging technologies offering a ‘need-to-have’ value proposition within specific domains.

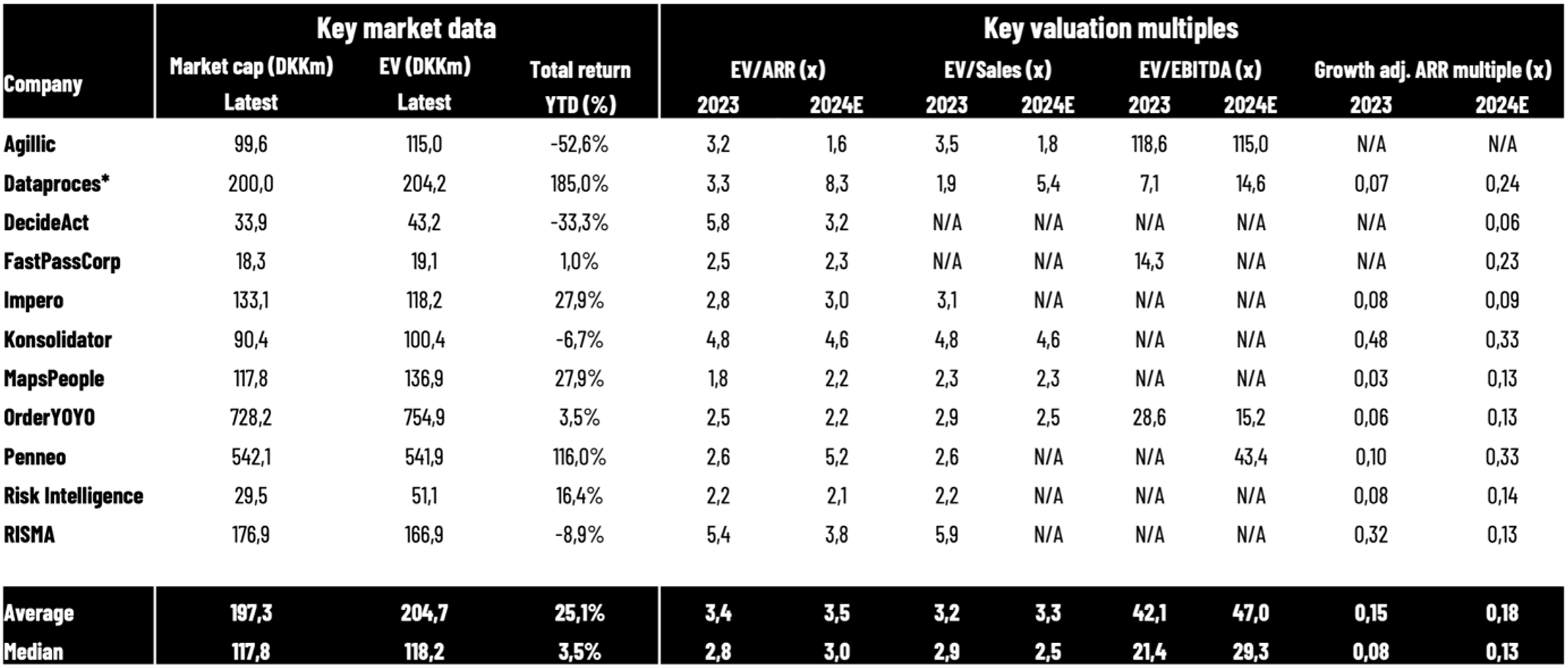

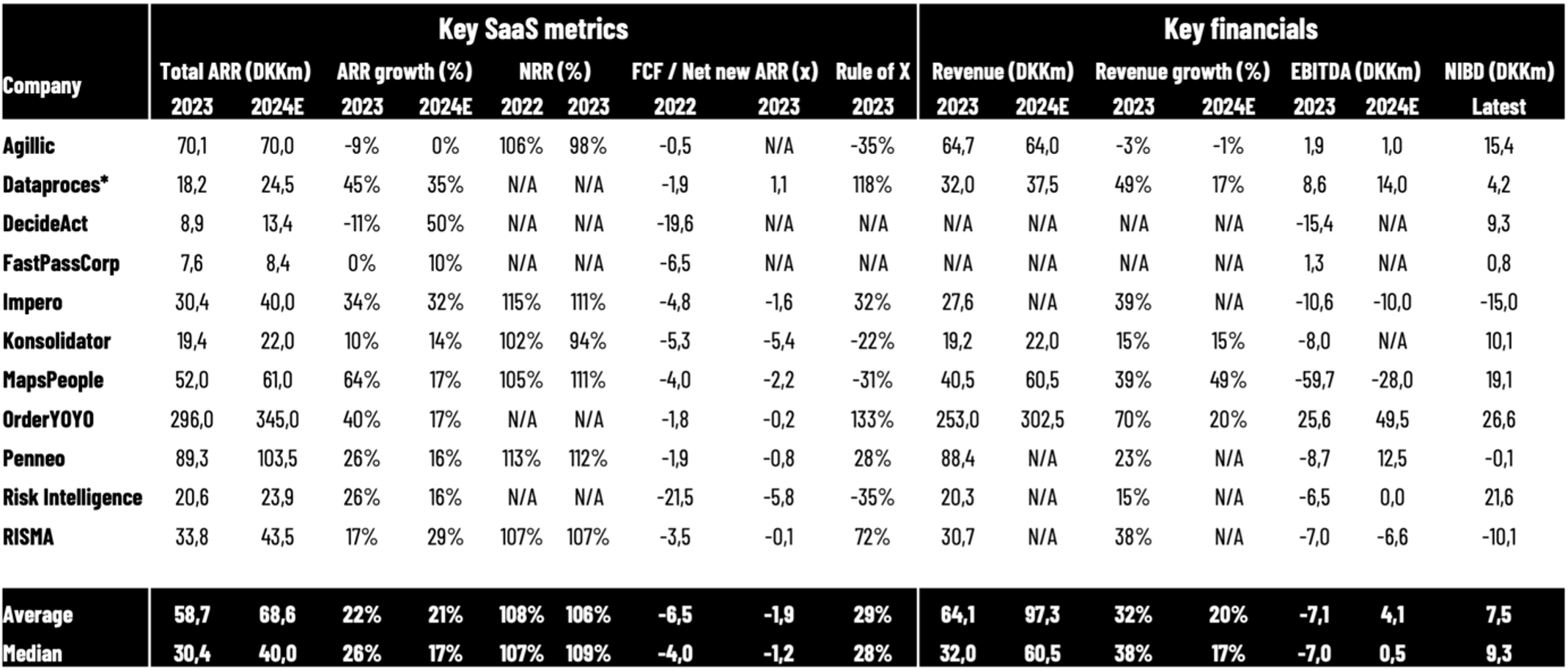

Overview of key metrics for Danish SaaS companies

We have collected data from 11 listed Danish SaaS companies. The overview will be updated on an ongoing basis. Market capitalizations are latest updated on 31 December 2024. Read the note below the tables for more detailed information.

Note: The table above summarizes key market data, key valuation multiples, key SaaS metrics, and key financials for Danish-listed SaaS companies reporting ARR (some software companies such as cBrain do not include ARR in their reporting and are not included). *Dataproces has a skewed/different accounting period than a regular calendar year. We apply the companies’ reported SaaS metrics, however, there are differences in the reporting methodologies, as there are no regulations or standards yet. When applying 2024E for the companies, we are using the companies’ guidance ranges (midpoint). We apply OrderYOYO’s pro forma net revenue in this overview (app smart consolidated full year) for both valuation multiples and growth rates. FCF/Net new ARR (2022) is calculated by taking FCF (cash flow from operations minus CAPEX, primarily investments in intangible assets) and the net ARR increase by the end of 2022 compared to the end of 2021. Penneo adjusts its FCF/Net new ARR ratio by DKK 2.4m due to costs related to the listing on the Main Market. Taking these costs out, the ratio will decline from -1.9x to -1.7x. In the calculation of net-interest-bearing debt (NIBD) for the companies in 2022, we have applied interest-bearing debt (including leasing liabilities) minus cash. This implies that negative values are companies with more cash than interest-bearing debt on their balance sheet. We apply the latest reported NIBD (for most companies) and market capitalizations from 31 December 2023 in our calculations of Enterprise Value multiples for 2023, and market capitalizations from 31 December 2024 for 2024E. MapsPeople’s net revenue retention rate (NRR) is based on MapsIndoors. All data is collected manually from reports, and we cannot guarantee the correctness of all data. Source: HC Andersen Capital and company reports.

Disclaimer: HC Andersen Capital receives payment from some of the mentioned SaaS companies (Agillic, Impero, MapsPeople, OrderYOYO, and Penneo) for a Digital IR/Corporate Visibility subscription agreement. All content in this newsletter is only for informational purposes. HC Andersen Capital cannot guarantee the correctness of all data in this newsletter.