Mixed growth picture, but clear improvement in profitability

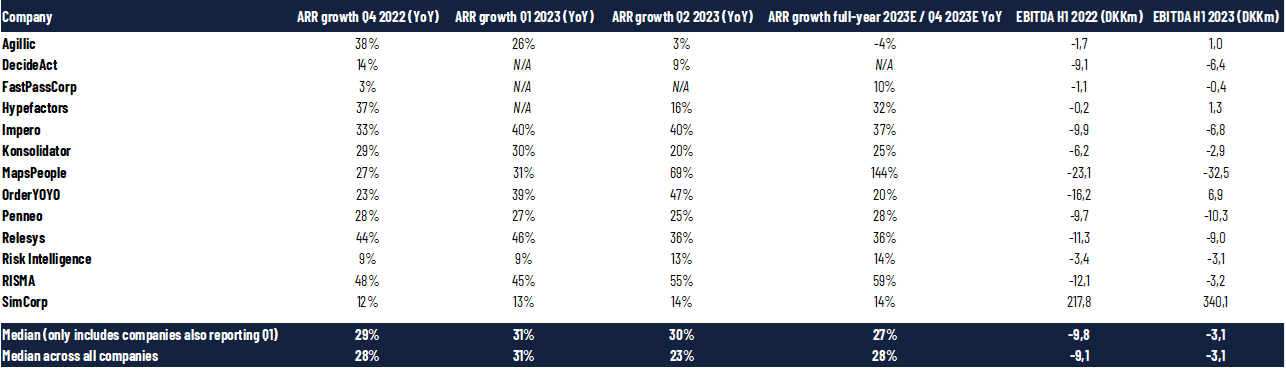

It is hard to say something general that covers the entire Danish SaaS sector, as we see that some end markets perform very well such as GRC (Impero and RISMA) and others still see slower growth rates from prolonged decision processes. However, it is clear that the limited access to new capital and investors’ increasing focus on profitability has affected the profitability levels in a positive direction. Specifically, the median EBITDA was approx. DKK -3m in H1 2023 compared to DKK -10m in H1 2022 and thus closer to a breakeven level in the first half of 2023.

In the overview below (we have excluded some companies that do not follow the calendar year in the reporting as well as Digizuite which is now delisted), we have included a median for the SaaS companies that also reported Q1 (some companies only report H1 and full year) to compare apples with apples. From that view, the median ARR growth YoY is 30% (from 29% in Q4 2022 and 31% in Q1 2023). Across all the SaaS companies (including companies that only report H1), however, the median ARR growth rate is lower at 23%, as some of the smaller companies that are not reporting Q1 numbers have grown less in H1 2023. Therefore, taking these observations into account does not give us a clear direction for the development of the growth rate.

Another way to shed light on the recent growth picture is to look at how many companies have accelerated or decelerated the ARR YoY growth rate in Q2 2023 vs. Q4 2022 (full year 2022). Here the answer is that out of the 13 companies in the chart below, 6 of the Danish SaaS companies have had higher ARR growth rates YoY recently, and 6 of the Danish SaaS companies have had lower ARR growth rates YoY recently, while we have missing data for 1 company. This fits with the “mixed” growth picture we have seen.

Now, comparing the Q2 2023 data (ARR YoY growth rate) with the companies’ 2023 ARR guidance (midpoint in the companies’ own guidance range), we see that 5 companies are in line or ahead of the expected ARR growth rate for the end of 2023, and 6 companies need to increase the YoY growth rate in H2 2023 to reach its midpoint in the ARR 2023 guidance range. 1 company did not report ARR in Q2 2023, and 1 company has no ARR guidance for 2023.

Again, we acknowledge that it is very hard to say something general, as the companies are different in lifecycles, end-markets, and to some extent also some differences in their SaaS business model. The differences are also shown by the very large differences in the ARR growth rates, spanning from 3% YoY to 69% YoY across the companies. Nevertheless, it hopefully provides some perspectives.

Note: We have excluded Dataproces (does not follow a regular calendar year), SameSystem (does not follow a regular calendar year), and Digizuite (now delisted). Some growth rates are marked as “N/A”, as we do not have sufficient data. Source: HC Andersen Capital and company reports. OrderYOYO’s growth includes M&A. Please note that data is manually collected, and there can be errors.

Some perspectives on the global SaaS earnings season

Referring to work by Jamin Ball, Clouded Judgement (A Look Back at Q2 ’23 Public Cloud Software Earnings), we have insights into 62 US-listed SaaS companies. Here, the main message is that most companies still see macro pressures, however, things are not getting worse. In Q2 2023, the median guidance beat (over analyst consensus) was 0.1% vs. 0.3% in Q1 2023, -1.1% in Q4 2022, -0.1% in Q3 2022, 0.1% in Q2 2022, and 0.8% in Q1 2022. As the US SaaS companies also guide on the next quarter (Q3 2023), this is compared with the consensus estimates from analysts. Here, 56% of the companies guided above the analyst consensus, which overall sounds good; however, this number is down from 61% in Q1 2023.

Looking at growth rates, the median revenue growth rate YoY has declined to a lower level of 19% in Q2 2023 vs. 22% in Q1 2023 and 26% in Q4 2022. As mentioned by Jamin Ball in the newsletter, it is not possible to claim yet that we have reached the bottom before we have the Q3 data in 2 months. However, YoY comparison numbers from Q3 2022 (overall a challenging quarter) will start from the next quarter, meaning that it is likely that some companies will start to accelerate their YoY growth again.

The first US SaaS IPO in almost two years could be close

As mentioned in last month’s SaaS newsletter, we have seen a comeback for some of the larger global US-listed SaaS companies in H1 2023, mainly driven by the AI hype. The more positive market sentiment has also opened the IPO window in the United States, as the marketing automation software company, Klaviyo, has filed its initial S1 statement (a document companies file with the SEC before listing) in late August. This is the first filing in nearly two years from a software company. We have looked slightly into the company based on data from here (https://seekingalpha.com/article/4634420-ipo-update-klaviyo-readies-500-million-ipo-plan and https://www.meritechcapital.com/blog/klaviyo-ipo-s-1-breakdown).

Klaviyo is a SaaS company that assists marketers to improve its communication with online customers and prospects. The company expects to raise approx. USD 500 million in the IPO. Enterprise value (excluding underwriter options) is expected to be approx. USD 5.9 billion. The implied ARR (latest quarterly revenue*4) was USD 658.3m (51% growth YoY), and revenue LTM was USD 585.1m (57% growth YoY). Also very relevant is that the company has been operationally profitable in the past two quarters. With the implied ARR and revenue (LTM), the valuation is approx. 9x EV/Implied ARR and approx. 10x EV/Sales. This is below the multiples of larger companies such as HubSpot and Adobe (approx. 13x EV/Sales LTM).

It is especially the growth rates that have been impressive for Klaviyo. Looking at some of the SaaS metrics, Klaviyo’s net revenue retention rate was 119% YoY in the last quarter, which has been stable. The average annual contract value is USD 5,100, as most of the company’s customers are small- and medium-sized companies.

Despite the S1-filing, the exact IPO date is still uncertain, as the company has not specified an IPO date yet. The process and outcome from here will be exciting to follow.